This text is machine-read, and may contain errors. Check the original document to verify accuracy.

ATTACHMENT 5

RATES AND REVENUE SHARE.

On a monthly basis, Contractor shall pay the State Entity a monthly payment which shall be the ·greater of

the Revenue·Share (defined as the product of the Revenue Share Percentage ·and the Gross Revenue) or

MMG a·~ defined below. Contractor shall follow the payment requirements in Attachment 2 - Scope of

Services, Section 22 - Payment and Reporting of the Contract. If the amount of t,h e Revenue Share

calculated on the Gross Revenu!'l (as defineq) is, less than the MMG; the State Entity shall not be

r~sponsible for refunding any portion of the MMG to Contractor.

Revenue Share Percentage: The amount of Revenue Share due the State Entity will be determine.d by

multiplying the amount of Gross Revenue (as defined Attachment 2 - S.c ope of Services, Section 19 Revenue. Share, as SllT\ended) by 59.6% .

. MMG: Contractor shall pay the State Entity a Minimt,1m Monthly Guarantee (MMG) payment In the am·ourit

of $325,000.00 for each month under the Contract for the ITS.

Financial Incentive:. Contractor provided the State Entity a one~time Financial Incentive in the amount <if

$4,000,000.00 on January 4, 2017 ("Financial Incentive").

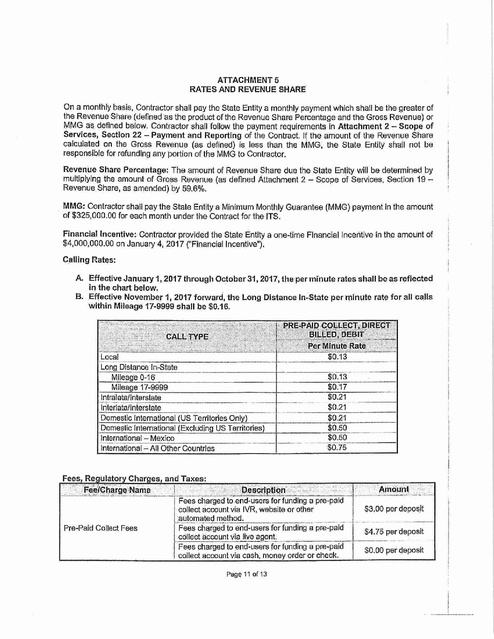

C_a lling Rates:

A. Effective January 1, 2017 through October 31, 2017, the per mrnute rates shall be as refle.cted

in the chart below.

·

B. Effective Novem.b er 1, 2017 forward, the Long Distance In-State per minute rat~ for all c~lls

Within Mileage 17-9999 shall be $0.16.

- -·--·--Long Distance lh-State

Miieage 0-16"

$0.13

Mileage 17-9999

- - - - $D.1_7______

•-,-n-tra-1-at-a/-=-ln-t-e r-s-ta-te- - - - - - - - - - - - j - - - - - $0.21

Tnterlata/.lnT~rstate

$0 ..21

- -- - - - -1------ ---,--- - -- - -

Domestic. lnternatkmal (US territones Only) .

Qomestic lnterriaJtonal (Excluding US Territories)

:international - Me.xi~o

$0.2·1

- - -·

$0.50

International -All Other Countries

$0. 7-5

$0.50__ __ __,

Fees, ReQulatorv Charnes, and Taxes:

.:~-~~};i~~~·~r.9~-;~_a·~~-~- _'_:~~l:.~~scti~~~~a\i1~~~t~:::1!~~~:~~~-~~-·?:~r~-p~1~ .~\~--~._'~~ ~~'!'-~~~:._,;·~ .·'· :·:.

collect account via IVR,webslte or other

:automated method.

Pre-Paid Collect Fees

I

$3,00 per depos.it

-·Fee~-chir9icl"toe-nd--use-.rs-i0rfunding ~ P.r~-paid ·· 1 ·· $ . per·deposit

4 75

. collect account via liye a~en~·---------~L _ __ __ _ __

Fees Gharged to end'-users for f1,mding a pre-paid j $O.OO per deposit

collect account via cash, money order or check.

Pag~

11of13

i

--···--'----

�Fees charged to end-users for funding a pre-paid

collect account via third-parties:

Pre-Paid Collect Transaction

Fee

100% Pass Through;

No Mark·up Allowed

Money Gram:

$10.99 per deposit

Western Union:

$3.95 per deposit

JPay Online Funding:

$3.50 per deposit

Debit Refund Fee

Fee charged to inmates for obtaining a refund for

unused debit funds via Western Union.

Universal Service Fund

Universal Service Fund Is applied to only interstate

calls and Is changed quarterly by the FCC.

Applicable Taxes

All required taxes are allowed.

Pre-Paid Collect Account

Funding Minimum

Minimum amount a called party can deposit when

opening/fundlng a pre-paid collect account.

$0.00

Pre-Paid Collect Account

Funding Maximum

Maximum amount a called party can deposit when

opening/funding a pre-paid collect account.

$200.00

All Other Fees

Fees or charges applied by Contractor or a third

party for calls processed through the inmate

telephone system from the State Entity's Facilities.

$0.00

$1.50

16.7%"'

*adjusted quarterly

Vary

100% Pass Through;

No Mark-up Allowed

Volcemail Messaging: The rate for voicemall messages shall be $1.00 per completed voicemail message,

and Contractor shall pay $0. 75 to the State Entity for each voicemall message completed by the end user

to the inmate. Contractor shall provide the $0.75 payment to the State Entity on each completed volcemall

message before any deductions are made for unblllable transactions, bad debt, rejected volcemall

messages, uncollectible transactions, fraudulent transactions, merchant adjustments, malfunctions, or any

other Contractor expenses. Additionally, the State Entity shall not be liable for any of Contractor's costs

including, but not limited to, taxes, shipping charges, network charges, insurance, interest, penalties,

termination payments, attorney fees, or liquidated damages. The State Entity can cancel voicemall

messaging at any time during the Contract without penalty.

Cost Reimbursement Payment: Should a material change In the rules or policies of the FCC or other

regulatory body applicable to ITS occur following the execution of this Contract, which change affects: (1)

the ITS rates permitted to be charged by the Contractor to inmates under this Contract; (2) the right of the

State Entity to recover Its ICS costs: or (3) the ability of the State Entity to require Contractor to pay to the

State Entity Revenue Share, fees (Including but not limited to the a cost reimbursement payment) or other

ITS cost recovery mechanisms, then, at the State Entity's request, Contractor and the State Entity will

negotiate in good faith an Amendment to the Contract, reasonably acceptable to the State Entity, that

enables the State Entity to fully recover Its ITS costs in a manner compliant with the change in the FCC's

or other regulatory body's ITS rules or policies.

Page 12of13