This text is machine-read, and may contain errors. Check the original document to verify accuracy.

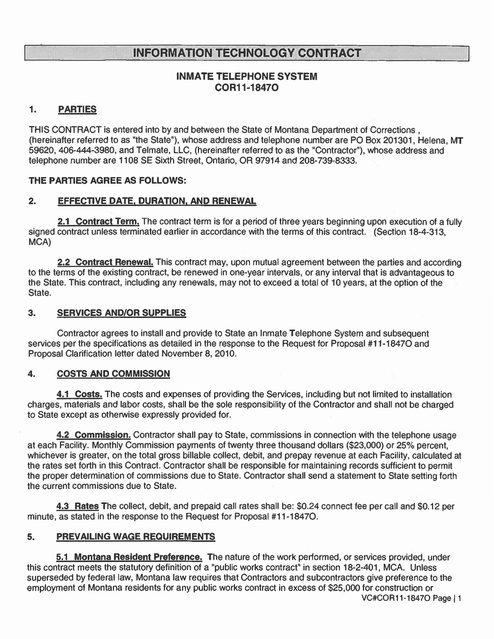

INFORMATION TECHNOLOGY CONTRACT

INMATE TELEPHONE SYSTEM

COR11·18470

1.

PARTIES

THIS CONTRACT is entered into by and between the State of Montana Department of Corrections,

(hereinafter referred to as "the State"), whose address and telephone number are PO Box 201301, Helena, MT

59620,406-444-3980, and Telmate, LLC, (hereinafter referred to as the "Contractor"), whose address and

telephone number are 1108 SE Sixth Street, Ontario, OR 97914 and 208-739-8333.

THE PARTIES AGREE AS FOLLOWS:

2.

EFFECTIVE DATE. DURATION. AND RENEWAL

2.1 Contract Term. The contract term is for a period of three years beginning upon execution of a fully

signed contract unless terminated earlier in accordance with the terms of this contract. (Section 18-4-313,

MCA)

2.2 Contract Renewal. This contract may, upon mutual agreement between the parties and according

to the terms of the existing contract, be renewed in one-year intervals, or any interval that is advantageous to

the State. This contract, including any renewals, may not to exceed a total of 10 years, at the option of the

State.

3.

SERVICES AND/OR SUPPLIES

Contractor agrees to install and provide to State an Inmate Telephone System and subsequent

services per the specifications as detailed in the response to the Request for Proposal #11-18470 and

Proposal Clarification letter dated November 8, 2010.

4.

COSTS AND COMMISSION

4.1 Costs. The costs and expenses of providing the Services, including but not limited to installation

charges, materials and labor costs, shall be the sole responsibility of the Contractor and shall not be charged

to State except as otherwise expressly provided for.

4.2 Commission. Contractor shall pay to State, commissions in connection with the telephone usage

at each Facility. Monthly Commission payments of twenty three thousand dollars ($23,000) or 25% percent,

whichever is greater, on the total gross billable collect, debit, and prepay revenue at each Facility, calculated at

the rates set forth in this Contract. Contractor shall be responsible for maintaining records sufficient to permit

the proper determination of commissions due to State. Contractor shall send a statement to State setting forth

the current commissions due to State.

4.3 Rates The collect, debit, and prepaid call rates shall be: $0.24 connect fee per call and $0.12 per

minute, as stated in the response to the Request for Proposal #11-18470.

5.

PREVAILING WAGE REQUIREMENTS

5.1 Montana Resident Preference. The nature of the work performed, or services provided, under

this contract meets the statutory definition of a "public works contract" in section 18-2-401, MCA. Unless

superseded by federal law, Montana law requires that Contractors and subcontractors give preference to the

employment of Montana residents for any public works contract in excess of $25,000 for construction or

VC#COR11-18470 Page

11

�nonconstruction services in accordance with sections 18-2-401 through 18-2-432, MCA, and all administrative

rules adopted in relation to these statutes.

Unless superseded by federal law, each Contractor shall ensure that at least 50% of a Contractor's workers

performing labor on a construction project are bona fide Montana residents.

The Commissioner of the Montana Department of Labor and Industry has established the resident

requirements in accordance with sections 18-2-403 and 18-2-409, MCA. Any and all questions concerning

prevailing wage and Montana resident issues should be directed to the Montana Department of Labor and

Industry.

5.2 Standard Prevailing Rate of Wages. In addition, unless superseded by federal law, all

employees working on a public works contract shall be paid prevailing wage rates in accordance with sections

18-2-401 through 18-2-432, MCA, and all associated administrative rules. Montana law requires that all public

works contracts, as defined in section 18-2-401, MCA, in which the total cost of the contract is in excess of

$25,000, contain a provision stating for each job classification the standard prevailing wage rate, including

fringe benefits, travel, per diem, and zone pay that the Contractors, subcontractors, and employers shall pay

during the public works contract.

The standard prevailing rate of wages paid to workers under this contract must be adjusted 12 months after the

date of the award of the public works contract per section 18-2-417, MCA. The amount of the adjustment must

be a 3% increase. The adjustment must be made and applied every 12 months for the term of the contract.

This adjustment is the sole responsibility of the Contractor and no cost adjustment in this contract will be

allowed to fulfill this requirement.

Furthermore, section 18-2-406, MCA, requires that all Contractors, subcontractors, and employers who are

performing work or providing services under a public works contract post in a prominent and accessible site on

the project staging area or work area, no later than the first day of work and continuing for the entire duration of

the contract, a legible statement of all wages and fringe benefits to be paid to the employees in compliance

with section 18-2-423, MCA.

Section 18-2-423, MCA, requires that employees receiVing an hourly wage must be paid on a weekly basis.

Each Contractor, subcontractor, and employer must maintain payroll records in a manner readily capable of

being certified for submission under section 18-2-423, MCA, for not less than three years after the

Contractor's, subcontractor's, or employer's completion of work on the public works contract.

All Contractors and employers shall classify each employee who performs labor on a public works project

according to the applicable standard prevailing rate of wages for such craft, classification, or type of employee

established by the Commissioner of the Montana Department of Labor and Industry, and shall pay each such

employee a rate of wages not less than the standard prevailing rate as specified in the Montana Prevailing

Wages Rates for Building Construction and Non-Construction Services 2010.

6.

ACCESS AND RETENTION OF RECORDS

6.1 Access to Records. The Contractor agrees to provide the State, Legislative Auditor, or their

authorized agents access to any records required to be made available by 18-1-118 MCA, in order to

determine contract compliance.

6.2 Retention Period. The Contractor agrees to create and retain records supporting the Inmate

Telephone System for a period of three years after either the completion date of this contract or the conclusion

of any claim, litigation, or exception relating to this contract taken by the State of Montana or a third party.

VC#COR11-18470 Page

12

�7.

ASSIGNMENT. TRANSFER. AND SUBCONTRACTING

The Contractor shall not assign, transfer, or subcontract any portion of this contract without the express written

consent of the State. (Section 18-4-141, MCA)

8.

LIMITATION OF LIABILITY

The Contractors liability for contract damages is limited to direct damages and further to no more than twice

the contract amount. The Contractor shall not be liable for special, incidental, consequential, punitive, or

indirect damages. Damages caused by injury to persons or tangible property, or related to intellectual property

indemnification, are not subject to a cap on the amount of damages.

9.

REQUIRED INSURANCE

9.1 General Requirements. The Contractor shall maintain for the duration of this contract, at its cost

and expense, insurance against claims for injuries to persons or damages to property, including contractual

liability, which may arise from or in connection with the performance of the work by the Contractor, agents,

employees, representatives, assigns, or subcontractors. This insurance shall cover such claims as may be

caused by any negligent act or omission.

9.2 Primary Insurance. The Contractor's insurance coverage with respect to the Contractor's

negligence shall be primary insurance with respect to the State, its officers, officials, employees, and

volunteers and shall apply separately to each project or location. Any insurance or self-insurance maintained

by the State, its officers, officials, employees, or volunteers shall be excess of the Contractors insurance and

shall not contribute with it.

9.3 Specific Requirements for Commercial General Liability. The Contractor shall purchase and

maintain occurrence coverage with combined single limits for bodily injury, personal injury, and property

damage of $1,000,000 per occurrence and $2,000,000 aggregate per year to cover such claims as may be

caused by any act, omission, or negligence of the Contractor or its officers, agents, representatives, assigns,

or subcontractors.

The State, its officers, officials, employees, and volunteers are to be covered and listed as additional insureds;

for liability arising out of activities performed by or on behalf of the Contractor, including the insured's general

supervision of the Contractor; products and completed operations; premises owned, leased, occupied, or used.

9.4 Specific Requirements for Automobile Liability. The Contractor shall purchase and maintain

coverage with split limits of $500,000 per person (personal injury), $1,000,000 per accident occurrence

(personal injury), and $100,000 per accident occurrence (property damage), OR combined single limits of

$1.000,000 per occurrence to cover such claims as may be caused by any act, omission, or negligence of the

Contractor or its officers, agents, representatives, assigns, or subcontractors.

The State, its officers, officials, employees, and volunteers are to be covered and listed as additional insureds

for automobiles leased, hired, or borrowed by the Contractor.

9.5 Deductibles and Self-Insured Retentions. Any deductible or self-insured retention must be

declared to and approved by the state agency. At the request of the agency, the Contractor will elect to either:

(1) the insurer shall reduce or eliminate such deductibles or self-insured retentions as respects the State, its

officers, officials, employees, or volunteers; or (2) at the expense of the Contractor, the Contractor shall

procure a bond guaranteeing payment of losses and related investigations, claims administration, and defense

expenses.

9.6 Certificate of Insurance/Endorsements. A certificate of insurance from an insurer with a Best's

rating of no less than B++ indicating compliance with the required coverages, has been received by the

Department of Corrections, Contracts Management Bureau, Attn: Contracts Manager, PO Box 201301,

VC#COR11-18470 Page 13

�Helena, MT 59620-1301. The Contractor must notify the State immediately, of any material change in

insurance coverage, such as changes in limits, coverages, change in status of policy, etc. The State reserves

the right to require certificates of insurance policies at all times.

10.

COMPLIANCE WITH WORKERS' COMPENSATION ACT

Contractors are required to comply with the provisions of the Montana Workers' Compensation Act while

performing work for the State of Montana in accordance sections 39-71-401,39-71-405, and 39-71-417, MCA.

Proof of compliance must be in the form of workers' compensation insurance, an independent contractor's

exemption, or documentation of corporate officer status. Neither the Contractor nor its employees are

employees of the State. This insurance/exemption must be valid for the entire term of this contract. A renewal

document must be sent to the Department of Corrections, Contracts Management Bureau, Attn: Contracts

Manager, PO Box 201301, Helena, MT 59620-1301, upon expiration.

11.

COMPLIANCE WITH LAWS

The Contractor must, in performance of work under this contract, fully comply with all applicable federal, state,

or local laws, rules, and regulations, including the Montana Human Rights Act, the Civil Rights Act of 1964, the

Age Discrimination Act of 1975, the Americans with Disabilities Act of 1990, and Section 504 of the

Rehabilitation Act of 1973. Any subletting or SUbcontracting by the Contractor subjects subcontractors to the

same provision. In accordance with section 49-3-207, MCA, the Contractor agrees that the hiring of persons to

perform this contract will be made on the basis of merit and qualifications and there will be no discrimination

based upon race, color, religion, creed, political ideas, sex, age, marital status, physical or mental disability, or

national origin by the persons performing this contract.

12.

INTELLECTUAL PROPERTY/OWNERSHIP

12.1 Mutual Use. All patent and other legal rights in or to inventions first conceived and reduced to

practice, created in whole or in part under this contract, must be available to the State for royalty-free and

nonexclusive licensing if necessary to receive the mutually agreed upon benefit under this contract. Unless

otherwise specified in a statement of work, both parties shall have a royalty-free, nonexclusive, and irrevocable

right to reproduce, publish, or otherwise use and authorize others to use copyrightable property created under

this contract including all deliverables and other materials, products, modifications developed or prepared for

the State by the Contractor under this contract or any program code, including site related program code,

created, developed, or prepared by the Contractor under or primarily in support of the performance of its

specific obligations hereunder, including manuals, training materials, and documentation (the 'Work Product").

12.2 Title and Ownership Rights. The State shall retain title to and all ownership rights in all data

and content, inclUding but not limited to multimedia or images (graphics, audio, and video), text, and the like

provided by the State (the "contenf'), but grants the Contractor the right to access and use content for the

purpose of complying with its obligations under this contract and any applicable statement of work.

12.3 Ownership of Work Product. The Contractor agrees to execute any documents or take any

other actions as may reasonably be necessary, or as the State may reasonably request, to perfect the State's

ownership of any Work Product.

12.4 Copy of Work Product The Contractor shall, at no cost to the State, deliver to the State, upon

the State's request during the term or at the expiration or termination of all or part of the Contractor's

performance hereunder, a current copy of all Work Product in the form and on the media in use as of the date

of the State's request, or as of such expiration or termination, as the case may be.

12.5 Ownership of Contractor Pre-Existing Materials. Literary works or other works of authorship

(such as software programs and code, documentation, reports, and similar works), information, data,

intellectual property, techniques, subroutines, algorithms, methods or rights thereto and derivatives thereof

owned by the Contractor at the time this contract is executed or otherwise developed or acqUired independent

VC#COR11-18470 Page

14

�of this contract and employed by the Contractor in connection with the services provided to the State (the

"Contractor Pre-Existing Materials") shall be and remain the property of the Contractor and do not constitute

Work Product. The Contractor must provide full disclosure of any Contractor Pre-Existing Materials to the State

prior to its use and prove its ownership, provided, however, that if the Contractor fails to disclose to the State

such Contractor Pre-Existing Materials, the Contractor shall grant the State a nonexclusive, worldwide, paid-up

license to use any Contractor Pre-Existing Materials embedded in the Work Product to the extent such

Contractor Pre-Existing Materials are necessary for the State to receive the intended benefit under this

contract. Such license shall remain in effect for so long as such Pre-Existing Materials remain embedded in

the Work Product. Except as otherwise provided for in Section 12.3 or as may be expressly agreed in any

statement of work, the Contractor shall retain title to and ownership of any hardware provided by the

Contractor.

13.

PATENT AND COPYRIGHT PROTECTION

13.1 Third-Party Claim. In the event of any claim by any third party against the State that the

products furnished under this contract infringe upon or violate any patent or copyright, the State shall promptly

notify the Contractor. The Contractor shall defend such claim, in the State's name or its own name, as

appropriate, but at the Contractor's expense. The Contractor will indemnify the State against all costs,

damages, and attorney's fees that accrue as a result of such claim. Such indemnification will be conditional

upon the following:

a. the State will promptly notify the Contractor of the claim in writing; and

b. the State will allow the Contractor to control, and will cooperate with the Contractor in the defense

and any related settlement negotiations, provided that:

i. the Contractor will permit the State to participate in the defense and settlement of any such

claim, at the State's own expense, with counsel of its choosing; and

ii. the Contractor shall not enter into or agree to any settlement containing any admission of or

stipulation to any guilt, fault, liability or wrongdoing on the part of the State, its elected and

appointed officials, agents or employees without the State's prior written consent.

13.2 Product Subject of Claim. If any product furnished is likely to or does become the subject of a

claim of infringement of a patent or copyright, then the Contractor may, at its option, procure for the State the

right to continue using the alleged infringing product, or modify the product so that it becomes noninfringing or

replace it with one that is at least functionally equivalent. If none of the above options can be accomplished, or

if the use of such product by the State shall be prevented by injunction, the State agrees to return the product

to the Contractor on written request. The Contractor will then give the State a credit equal to the amount paid

to the Contractor for the creation of the Work Product. This is the Contractor's entire obligation to the State

regarding a claim of infringement. The State is not precluded from seeking other remedies available to it

hereunder, including Section 9, and in equity or law for any damages it may sustain due to its inability to

continue using such product.

13.3 Claims for Which Contractor is Not Responsible. The Contractor has no obligation regarding

any claim based on any of the following except where the Contractor has agreed in writing, either separately or

within this contract, to such use that is the basis of the claim:

a. anything the State provided which is incorporated into a Work Product except:

i. where the Contractor knew (and the State did not know) such thing was infringing at the time of

its incorporation into a Work Product but failed to advise the State; or

ii. where the claim would not have been brought except for such incorporation;

b. the State's modification of a Work Product furnished under this contract;

c. the use of a Work Product in a manner that could not be reasonably contemplated within the agreed

upon scope of the applicable project; or

d. infringement by a non-Contractor Work Product alone.

VC#COR11·18470 Page 15

�14.

CONTRACT OVERSIGHT

14.1 CIO Oversight The Chief Information Officer (CIO) for the State of Montana, or designee, may

perform contract oversight activities. Such activities may include the identification, analysis, resolution, and

prevention of deficiencies that may occur within the performance of contract obligations. The CIO may require

the issuance of a right to assurance or the issuance of a stop work order.

14.2 Right to Assurance. If the State, in good faith, has reason to believe that the Contractor does

not intend to, or is unable to perform or has refused to perform or continue performing all material obligations

under this contract, the State may demand in writing that the Contractor give a written assurance of intent to

perform. Failure by the Contractor to provide written assurance within the number of days specified in the

demand (in no event less than five business days) may, at the State's option, be the basis for terminating this

contract under the terms and conditions or other rights and remedies available by law or provided by this

contract.

14.3 Stop Work Order. The State may, at any time, by written order to the Contractor, reqUire the

Contractor to stop any or all parts of the work required by this contract for the period of days indicated by the

State after the order is delivered to the Contractor. The order shall be specifically identified as a stop work

order issued under this clause. Upon receipt of the order, the Contractor shall immediately comply with its

terms and take all reasonable steps to minimize the incurrence of costs allocable to the work covered by the

order during the period of work stoppage. If a stop work order issued under this clause is canceled or the

period of the order or any extension expires, the Contractor shall resume work. The State Project Manager

shall make the necessary adjustment in the delivery schedule or contract price, or both, and this contract shall

be amended in writing accordingly.

15.

CONTRACT TERMINATION

15.1 Termination for Cause. The State or the Contractor may, by written notice to the other party,

terminate this contract in whole or in part at any time the other party fails to perform this contract pursuant to

Section 16, Event of Breach - Remedies.

15.2 Bankruptcy or Receivership. Voluntary or involuntary bankruptcy or receivership by the

Contractor may be cause for termination.

15.3 Noncompliance with Department of Administration Requirements. The Department of

Administration, pursuant to section 2-17-514, MCA, retains the right to cancel or modify any contract, project,

or activity that is not in compliance with the Department's Plan for Information Technology, the State Strategic

Plan for Information Technology, or any Statewide IT policy or standard in effect as of the date of contract

execution. In the event of such termination, the State will pay for products and services delivered to date and

any applicable termination fee specified in the statement of work or work order. Any modifications to this

contract must be mutually agreed to by the parties.

15.4 Reduction of Funding. The State must terminate this contract if funds are not appropriated or

otherwise made available to support the State's continuation of performance of this contract in a subsequent

fiscal period. (See section 18-4-313(4), MCA.)

15.5 Termination for Convenience. The State, by providing at least 30 days prior written notice to

the Contractor, may terminate for convenience this contract and/or any active projects at any time. In the event

this contract is terminated for the convenience of the State, the agency will pay for all accepted work or

services performed and accepted deliverables completed in conformance with this contract up to the date of

termination.

VC#COR11-18470 Page 16

�16.

EVENT OF BREACH - REMEDIES

16.1 Event of Breach. Anyone or more of the following acts or omissions of the Contractor shall

constitute an event of breach:

a. products or services furnished by the Contractor fail to conform to any requirement of this contract;

or

b. failure to submit any report required by this contract; or

c. failure to perform any of the other covenants and conditions of this contract, including beginning

work under this contract without prior Department of Administration approval.

16.2 Actions in Event of Breach. Upon the occurrence of any material breach of this contract, either

party may take either one, or both, of the following actions:

a. give the breaching party a written notice specifying the event of breach and requiring it to be

remedied within, in the absence of a greater specification of time, 30 days from the date of the

notice; and if the event of breach is not timely remedied, terminate this contract upon giving the

breaching party notice of termination; or

b. treat this contract as materially breached and pursue any of its remedies at law or in equity, or both.

17.

WAIVER OF BREACH

No failure by either party to enforce any provisions hereof after any event of breach shall be deemed a waiver

of its rights with regard to that event, or any subsequent event. No express failure of any event of breach shall

be deemed a waiver of any provision hereof. No such failure or waiver shall be deemed a waiver of the right of

either party to enforce each and all of the provisions hereof upon any further or other breach on the part of the

breaching party.

18.

STATE PERSONNEL

18.1 State Contract Manager. The State Contract Manager identified below is the State's single point

of contact and will perform all contract management pursuant to section 2-17-512, MCA, on behalf of the State.

Written notices, requests, complaints, or any other issues regarding this contract should be directed to the

State Contract Manager.

The State Contract Manager for this contract is:

Tia Snyder

PO Box 201301

Helena, MT 59620

406-444-4236

406-444-9818 Fax

tsnyder2@mt.gov

18.2 State Project Manager. The State Project Manager identified below will manage the day-to-day

project activities on behalf of the State and serve as Contract liaison for reporting purposes.

The State Project Manager for this contract is:

Dale Tunnell

5 S. Last Chance Gulch

Helena, MT 59601

406-444-4761

dtunnell@mt.gov

VC#COR11-18470 Page 17

�19.

CONTRACTOR PERSONNEL

19.1 Identification/Substitution of Personnel. The personnel identified or described in the

Contractor's proposal shall perform the services provided for the State under this contract. The Contractor

agrees that any personnel substituted during the term of this contract must be able to conduct the required

work to industry standards and be equally or better qualified than the personnel originally assigned. The State

reserves the right to approve the Contractor personnel assigned to work under this contract, and any changes

or substitutions to such personnel. The State's approval of a substitution will not be unreasonably withheld.

This approval or disapproval shall not relieve the Contractor to perform and be responsible for its obligations

under this contract. The State reserves the right to require Contractor personnel replacement. In the event that

Contractor personnel become unavailable, it will be the Contractor's responsibility to provide an equally

qualified replacement in time to avoid delays to the work plan.

19.2 Contractor Contract Manager. The Contractor Contract Manager identified below will be the

single point of contact to the State Contract Manager and will assume responsibility for the coordination of all

contract issues under this contract. The Contractor Contract Manager will meet with the State Contract

Manager and/or others necessary to resolve any conflicts, disagreements, or other contract issues.

The Contractor Contract Manager for this contract is:

Kevin O'Neil

1108 SE 6 th Street

Ontario, OR 97914

208-739-8333

Fax: 541-889-9630

kevin@telmate.com

19.3 Contractor Project Manager. The Contractor Project Manager identified below will manage the

day-to-day project activities on behalf of the Contractor:

The Contractor Project Manager for this contract is:

Kathryn Jarrell

188 King Street, Suite 602

San Francisco, CA. 94107

415-845-5347

415-845-5347

Fax: 415-704-3195

kathryn@telmate.com

20.

MEETINGS AND REPORTS

20.1 Technical or Contractual Problems. The Contractor is required to meet with the State's

personnel, or designated representatives, at no additional cost to the State, to resolve technical or contractual

problems that may occur during the term of this contract. Meetings will occur as problems arise and will be

coordinated by the State. Failure to participate in problem resolution meetings or failure to make a good faith

effort to resolve problems may result in termination of this contract.

20.2 Progress Meetings. During the term of this contract, the State's Project Manager will plan and

schedule progress meetings with the Contractor to discuss the progress made by the Contractor and the State

in the performance of their respective obligations. These progress meetings will include the State Project

Manager, the Contractor Project Manager, and any other additional personnel involved in the performance of

this contract as required. At each such meeting, the Contractor shall provide the State with a written status

report that identifies any problem or circumstance encountered by the Contractor, or of which the Contractor

gained knowledge during the period since the last such status report, which may prevent the Contractor from

VC#COR11-18470 Page 18

�completing any of its obligations or may generate charges in excess of those previously agreed to by the

parties. This may include the failure or inadequacy of the State to perform its obligation under this contract.

The Contractor shall identify the amount of excess charges, if any, and the cause of any identified problem or

circumstance and the steps taken to remedy the same.

20.3 Failure to Notify. In the event the Contractor fails to specify in writing any problem or

circumstance that materially impacts the costs of its delivery hereunder, including a material breach by the

State, about which the Contractor knew or reasonably should have known with respect to the period dUring the

term covered by the Contractor's status report, the Contractor shall not be entitled to rely upon such problem or

circumstance as a purported justification for an increase in the price for the agreed upon scope; provided,

however, that the Contractor shall be relieved of its performance obligations to the extent the acts or omissions

of the State prevent such performance.

20.4 State's Failure or Delay. For a problem or circumstance identified in the Contractor's status

report in which the Contractor claims was the result of the State's failure or delay in discharging any State

obligation, the State shall review same and determine if such problem or circumstance was in fact the result of

such failure or delay. If the State agrees as to the cause of such problem or circumstance, then the parties

shall extend any deadlines or due dates affected thereby, and provide for any additional charges by the

Contractor. If the State does not agree as to the cause of such problem or circumstance, the parties shall each

attempt to resolve the problem or circumstance in a manner satisfactory to both parties.

21.

CONTRACTOR PERFORMANCE ASSESSMENTS

21.1 Assessments. The State may conduct assessments of the Contractor's performance. The

Contractor will have an opportunity to respond to assessments, and independent verification of the assessment

may be utilized in the case of disagreement.

21.2 Record. Completed assessments may be kept on record at the State's Information Technology

Services Division and may serve as past performance data. Past performance data will be available to assist

agencies in the selection of IT service providers for future projects. Past performance data may also be utilized

in future procurement efforts.

22.

TRANSITION ASSISTANCE

If this contract is not renewed at the end of this term, or is terminated prior to the completion of a project, or if

the work on a project is terminated for any reason, the Contractor must provide for a reasonable, mutually

agreed period of time after the expiration or termination of this contract, all reasonable transition assistance

requested by the State, to allow for the expired or terminated portion of the services to continue without

interruption or adverse effect, and to facilitate the orderly transfer of such services to the State or its designees.

Such transition assistance will be deemed by the parties to be governed by the terms and conditions of this

contract, except for those terms or conditions that do not reasonably apply to such transition assistance. The

State shall pay the Contractor for any resources utilized in performing such transition assistance at the most

current rates provided by this contract. If there are no established contract rates, then the rate shall be mutually

agreed upon. If the State terminates a project or this contract for cause, then the State will be entitled to offset

the cost of paying the Contractor for the additional resources the Contractor utilized in prOViding transition

assistance with any damages the State may have otherwise accrued as a result of said termination.

23.

CHOICE OF LAW AND VENUE

This contract is governed by the laws of Montana. The parties agree that any litigation concerning this bid,

proposal or SUbsequent contract must be brought in the First Judicial District in and for the County of Lewis

and Clark, State of Montana and each party shall pay its own costs and attorney fees. (See section 18-1-401,

MCA.)

VC#COR11-18470 Page 19

�24.

SCOPE, AMENDMENT, AND INTERPRETATION

24.1 Contract This contract consists of 11 numbered pages, any Attachments as required, RFP1118470, as amended, and the Contractor's RFP response as amended. In the case of dispute or ambiguity

about the minimum levels of performance by the Contractor the order of precedence of document interpretation

is as follows: 1) amendments to this contract, 2) this contract, 3) the applicable statement of work, 4) RFP1118470, as amended, and 5) the Contractor's RFP response, as amended.

24.2 Entire Agreement. These documents contain the entire agreement of the parties. Any

enlargement, alteration or modification requires a written amendment signed by both parties.

25.

EXECUTION

The parties through their authorized agents have executed this contract on the dates set out below.

Montana Department of Corrections

PO Box 201301

Helena, MT 59620

BY:

Telmate, LLC

Ontario,

-----------------

Mike Ferriter, Director

Montana Department of Corrections

~j,

e

1108 SE Sixth Street

.£<;t)

::0

~

R 07014

I

~/V'

(Signature)

(Signature)

DATE: _ _....o<:2-=-...L·/~·

/ '-11-------

<..~{ L

,

DATE: _ _

II I

i

Approved as to Legal Content:

i)Mz4cL&Jv

(Date)

Legal Counsel

7i1ltlZ.-

Procurement Officer

State Procurement Bureau

IftY/~/1

,

(Date)

Chief Information Officer Approval:

The Contractor is notified that pursuant to section 2-17-514, MCA, the Department of Administration retains the

right to cancel or modify any contract, project, or activity that is not in compliance with the Agency's Plan for

Information Technology, the State Strategic Plan for Information Technology, or any statewide IT policy or

standard.

/-/7-1/

(Date)

VC#COR11-18470 Page 110

�ATTACHMENT A

PREVAILING WAGES RATES FOR BUILDING CONSTRUCTION 2010

Effective: February 12,2010

PREVAILING WAGES RATES FOR NON-CONSTRUCTION SERVICES 2010

Effective: February 12, 2010

These rates are not available electronically and have been included as a separate attachment.

�MONTANA

PREVAILING WAGE RATES FOR BUILDING CONSTRUCTION 2011

Effective: January 27, 2011

Brian Schweitzer, Governor

State of Montana

Keith Kelly, Commissioner

Department of Labor and Industry

To obtain copies of prevailing wage rate schedules, or for information relating to public works projects and payment of

prevailing wage rates, visit ERD at www.mtwagehourbopa.com or contact them at:

Employment Relations Division

Montana Department of Labor and Industry

P. O. Box 201503

Helena, MT 59620-1503

Phone 406-444-5600

TDD 406-444-5549

The Labor Standards Bureau welcomes questions, comments and suggestions from the public. In addition, we’ll

do our best to provide information in an accessible format, upon request, in compliance with the Americans with

Disabilities Act.

MONTANA PREVAILING WAGE REQUIREMENTS

The Commissioner of the Department of Labor and Industry, in accordance with Sections 18-2-401 and 18-2-402 of the

Montana Code Annotated, has determined the standard prevailing rate of wages for the occupations listed in this

publication.

The wages specified herein control the prevailing rate of wages for the purposes of 18-2-401, et seq., Montana Code

Annotated. It is required that each employer pay (as a minimum) the rate of wages, including fringe benefits, travel

allowance, and per diem applicable to the district in which the work is being performed as provided in the attached wage

determinations.

All Montana Prevailing Wage Rates are available on the internet at www.mtwagehourbopa.com or by contacting the

Labor Standards Bureau at (406) 444-5600 or TDD (406) 444-5549.

In addition, this publication provides general information concerning compliance with Montana’s Prevailing Wage Law and

the payment of prevailing wages. For detailed compliance information relating to public works contracts and payment of

prevailing wage rates, please consult the regulations on the internet at www.mtwagehourbopa.com or contact the Labor

Standards Bureau at (406) 444-5600 or TDD (406) 444-5549.

KEITH KELLY

Commissioner

Department of Labor and Industry

State of Montana

�TABLE OF CONTENTS

MONTANA PREVAILING WAGE REQUIREMENTS:

A.

B.

C.

D.

E.

F.

G.

H.

I.

J.

K.

L.

M.

N.

O.

P.

Date of Publication

……………………………………………………………………………………………………………….

Definition of Building Construction

………………………………………………………………………………………..........

Definition of Public Works Contract

…………………………………………………………………………………………....

Prevailing Wage Schedule

………………………………………………………………………………………………………

Rates to use for Projects …………………………………………………………………………………………………………

Wage Rate Adjustments for Multiyear Contracts ………………………………………………………………………………

Fringe Benefits …………………………………………………………………………………………………………………….

Per Diem

…………………………………………………………………………………………………………………………..

Prevailing Wage Districts …………………………………………………………………………………………………………

Computing Travel Benefits ………………………………………………………………………………………………………

Apprentices ………………………………………………………………………………………………………………………..

Posting Notice of Prevailing Wages …………………………………………………………………………………………….

Employment Preference

…………………………………………………………………………………………………….......

Building Construction Occupations Website ……………………………………………………………………………………

Welders’ Rates …………………………………………………………………………………………………………………….

Foremans’ Rates ………………………………………………………………………………………………………………….

i

i

i

i

i

i

ii

ii

ii

iii

iii

iii

iii

iii

iii

iii

WAGE RATES:

BOILERMAKERS ………………………………………………………………………………………………………………………..

BRICK, BLOCK AND STONE MASONS

………………………………………………………………………………………........

CARPENTERS …………………………………………………………………………………………………………………………..

CEMENT MASONS ……………………………………………………………………………………………………………………..

CONSTRUCTION EQUIPMENT OPERATORS

OPERATORS GROUP 2 ……………………………………………………………………………………………………………….

OPERATORS GROUP 3 ……………………………………………………………………………………………………………….

OPERATORS GROUP 4 ……………………………………………………………………………………………………………….

OPERATORS GROUP 5 ……………………………………………………………………………………………………………….

OPERATORS GROUP 6 ……………………………………………………………………………………………………………….

OPERATORS GROUP 7 ……………………………………………………………………………………………………………….

CONSTRUCTION LABORERS

LABORERS GROUP 1 ………………………………………………………………………………………………………………….

LABORERS GROUP 2 ………………………………………………………………………………………………………………….

LABORERS GROUP 3 ………………………………………………………………………………………………………………….

LABORERS GROUP 4 ………………………………………………………………………………………………………………….

DRYWALL APPLICATORS …………………………………………………………………………………………………………….

ELECTRICIANS (Including Building Automation Control) …………………………………………………………………………..

ELEVATOR CONSTRUCTORS ………………………………………………………………………………………………………..

FLOOR LAYERS ………………………………………………………………………………………………………………………..

GLAZIERS ………………………………………………………………………………………………………………………………..

INSULATION WORKERS-MECHANICAL (Heat and Frost) ………………………………………………………………………..

IRONWORKERS-STRUCTURAL STEEL AND REBAR PLACERS ……………………………………………………………….

MILLWRIGHTS …………………………………………………………………………………………………………………………..

PAINTERS (Including Paperhanger) …………………………………………………………………………………………………..

PILE BUCKS ……………………………………………………………………………………………………………………………..

PLASTERERS

…………………………………………………………………………………………………………………………..

PLUMBERS, PIPEFITTERS, AND STEAMFITTERS ………………………………………………………………………………..

ROOFERS ………………………………………………………………………………………………………………………………..

SHEET METAL WORKERS AND HEATING AND AIR CONDITIONING …………………………………………………………

SPRINKLER FITTERS ………………………………………………………………………………………………………………….

TAPERS ………………………………………………………………………………………………………………………………….

TEAMSTERS GROUP 2

……………………………………………………………………………………………………………….

TELECOMMUNICATIONS EQUIPMENT INSTALLERS ……………………………………………………………………………

TILE SETTERS …………………………………………………………………………………………………………………………..

1

1

2

2

3

3

4

4

4

5

5

6

6

7

7

8

8

9

9

9

10

10

11

11

12

12

13

13

14

14

14

15

15

�A. Date of Publication January 27, 2011

B. Definition of Building Construction

For the purposes of Prevailing Wage, the Commissioner of Labor and Industry has determined that building construction

occupations are defined to be those performed by a person engaged in a recognized trade or craft, or any skilled,

semiskilled, or unskilled manual labor related to the construction, alteration, or repair of a public building or facility, and

does not include engineering, superintendence, management, office or clerical work.

The Administrative Rules of Montana (ARM) 24.17.501(2) – 2(a), Public Works Contracts for Construction Services

Subject to Prevailing Wage Rates, states: “Building construction projects generally are the constructions of sheltered

enclosures with walk-in access for housing persons, machinery, equipment, or supplies. It includes all construction of

such structures, incidental installation of utilities and equipment, both above and below grade level, as well as incidental

grading, utilities and paving.

Examples of building construction include, but are not limited to, alterations and additions to buildings, apartment

buildings (5 stories and above), arenas (closed), auditoriums, automobile parking garages, banks and financial buildings,

barracks, churches, city halls, civic centers, commercial buildings, court houses, detention facilities, dormitories, farm

buildings, fire stations, hospitals, hotels, industrial buildings, institutional buildings, libraries, mausoleums, motels,

museums, nursing and convalescent facilities, office buildings, out-patient clinics, passenger and freight terminal

buildings, police stations, post offices, power plants, prefabricated buildings, remodeling buildings, renovating buildings,

repairing buildings, restaurants, schools, service stations, shopping centers, stores, subway stations, theaters,

warehouses, water and sewage treatment plants (buildings only), etc.”

C. Definition of Public Works Contract

Montana Code Annotated 18-2-401(11)(a), defines “public works contract” as “a contract for construction services let by

the state, county, municipality, school district, or political subdivision or for nonconstruction services let by the state,

county, municipality, or political subdivision in which the total cost of the contract is in excess of $25,000…”

D. Prevailing Wage Schedule

This publication covers only Building Construction occupations and rates. These rates will remain in effect until

superseded by a more current publication. Current prevailing wage rate schedules for Heavy Construction, Highway

Construction, and Nonconstruction Services occupations can be found on the internet at www.mtwagehourbopa.com or

by contacting the Labor Standards Bureau at (406) 444-5600 or TDD (406) 444-5549.

E. Rates to use for Projects

Rates to be used on a public works project are those that are in effect at the time the project and bid specifications are

advertised.

F. Wage rate adjustments for multiyear contracts

Section 18-2-417, Montana Code Annotated states:

“(1) Any public works contract that by the terms of the original contract calls for more than 30 months to fully perform

must include a provision to adjust, as provided in subsection (2), the standard prevailing rate of wages to be paid to the

workers performing the contract.

(2) The standard prevailing rate of wages paid to workers under a contract subject to this section must be adjusted 12

months after the date of the award of the public works contract. The amount of the adjustment must be a 3% increase. The

adjustment must be made and applied every 12 months for the term of the contract.

(3) Any increase in the standard rate of prevailing wages for workers under this section is the sole responsibility of the

contractor and any subcontractors and not the contracting agency.”

BUILDING CONSTRUCTION SERVICES 2011

Page i

EFFECTIVE JANUARY 27, 2011

�G. Fringe Benefits

Section 18-2-412, Montana Code Annotated states:

“(1) To fulfill the obligation...a contractor or subcontractor may:

(a) pay the amount of fringe benefits and the basic hourly rate of pay that is part of the standard prevailing rate of wages

directly to the worker or employee in cash;

(b) make an irrevocable contribution to a trustee or a third person pursuant to a fringe benefit fund, plan, or program that

meets the requirements of the Employee Retirement Income Security Act of 1974 or that is a bona fide program approved

by the U. S. department of labor; or

(c) make payments using any combination of methods set forth in subsections (1)(a) and (1)(b) so that the aggregate of

payments and contributions is not less than the standard prevailing rate of wages, including fringe benefits and travel

allowances, applicable to the district for the particular type of work being performed.

(2) The fringe benefit fund, plan, or program described in subsection (1)(b) must provide benefits to workers or employees

for health care, pensions on retirement or death, life insurance, disability and sickness insurance, or bona fide programs

that meet the requirements of the Employee Retirement Income Security Act of 1974 or that are approved by the U. S.

department of labor.”

Fringe benefits are paid for all hours worked (straight time and overtime hours). However, fringe benefits are not to be

considered a part of the hourly rate of pay for calculating overtime, unless there is a collectively bargained agreement in

effect that specifies otherwise.

H. Per Diem

Per Diem typically covers the costs associated with board and lodging expenses and are paid when an employee is

required to work at a location outside the daily commuting distance and is required to stay overnight or longer.

I. Prevailing Wage Districts

Montana counties are aggregated into 10 districts for the purpose of prevailing wage. The prevailing wage districts are

composed of the following counties:

BUILDING CONSTRUCTION SERVICES 2011

Page ii

EFFECTIVE JANUARY 27, 2011

�J. Computing Travel Benefits

Travel pay, for the purposes of public works projects, shall be determined by measuring the road miles (one way) over the

shortest practical maintained route from the county courthouse of the designated city for each district or the employee's

home, whichever is closer, to the center of the job. Each city shall be considered the point of origin only for jobs within

the counties identified in that district (as shown below):

District 1 - Kalispell: includes Flathead, Lake, Lincoln, and Sanders Counties

District 2 - Missoula: includes Mineral, Missoula, and Ravalli Counties

District 3 - Butte: includes Beaverhead, Deer Lodge, Granite, Madison, Powell, and Silver Bow Counties

District 4 - Great Falls: includes Blaine, Cascade, Chouteau, Glacier, Hill, Liberty, Pondera, Teton, and Toole Counties

District 5 - Helena: includes Broadwater, Jefferson, Lewis and Clark, and Meagher Counties

District 6 - Bozeman: includes Gallatin, Park, and Sweet Grass Counties

District 7 - Lewistown: includes Fergus, Golden Valley, Judith Basin, Musselshell, Petroleum, and Wheatland Counties

District 8 - Billings: includes Big Horn, Carbon, Rosebud, Stillwater, Treasure, and Yellowstone Counties

District 9 - Glasgow: includes Daniels, Garfield, McCone, Phillips, Richland, Roosevelt, Sheridan, and Valley Counties

District 10 - Miles City: includes Carter, Custer, Dawson, Fallon, Prairie, Powder River, and Wibaux Counties

When travel pay is applicable and is shown as an additional amount added to base pay, it means for hours worked

on the project, not time spent traveling.

K. Apprentices

Wage rates for apprentices registered in approved federal or state apprenticeship programs are contained in those

programs. Additionally, section 18-2-416(2), Montana Code Annotated states, “…The full amount of any applicable

fringe benefits must be paid to the apprentice while the apprentice is working on the public works contract.” Apprentices

not registered in approved federal or state apprenticeship programs will be paid the appropriate prevailing wage rate when

working on a public works contract.

L. Posting Notice of Prevailing Wages

Section 18-2-406, Montana Code Annotated provides that contractors, subcontractors and employers who are “performing

work or providing construction services under public works contracts, as provided in this part, shall post in a prominent

and accessible site on the project or staging area, not later than the first day of work and continuing for the entire

duration of the project, a legible statement of all wages and fringe benefits to be paid to the employees.”

M. Employment Preference

Sections 18-2-403 and 18-2-409, Montana Code Annotated requires contractors to give preference to the employment of

bona fide Montana residents in the performance of work on public works contracts.

N. Building Construction Occupations Website

You can find definitions for these occupations on the following Bureau of Labor Statistics website:

http://www.bls.gov/oes/current/oes_stru.htm

O. Welders’ Rates

Welders receive the rate prescribed for the craft performing an operation to which welding is incidental.

P. Foremans’ Rates

Rates are no longer set for foreman. However, if a foreman performs journey level work, the foreman must be paid at

least the journey level rate.

BUILDING CONSTRUCTION SERVICES 2011

Page iii

EFFECTIVE JANUARY 27, 2011

�WAGE RATES

BOILERMAKERS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$30.16

$30.16

$30.16

$30.16

$30.16

$30.16

$30.16

$30.16

$30.16

$30.16

Benefit

$22.24

$22.24

$22.24

$22.24

$22.24

$22.24

$22.24

$22.24

$22.24

$22.24

Travel:

All Districts

0-70 mi. free zone

>70-120 mi. $55/day

>120 mi. $70/day + current federal mileage rate/mi.

BRICK, BLOCK, AND STONE MASONS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$26.06

$26.06

$26.06

$25.16

$25.16

$25.16

$25.16

$25.16

$25.16

$25.16

Benefit

$ 9.35

$ 9.35

$ 9.35

$ 9.35

$ 9.35

$ 9.35

$ 9.35

$ 9.35

$ 9.35

$ 9.35

BUILDING CONSTRUCTION SERVICES 2011

Travel:

All Districts

0-45 mi. free zone

>45-60 mi. $25/day

>60-90 mi. $55/day

>90 mi. $65/day

Page 1

EFFECTIVE JANUARY 27, 2011

�CARPENTERS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$20.57

$20.82

$23.70

$19.74

$19.25

$19.25

$19.74

$19.74

$17.39

$19.74

Benefit

$6.26

$9.39

$7.90

$8.74

$6.62

$6.94

$9.09

$9.09

$2.15

$9.09

District 4

0-15 mi. free zone

>15-30 mi. base pay + $2.50/hr

>30-50 mi. base pay + $3.75/hr

>50 mi. base pay + $6.25/hr

Districts 5 & 6

0-15 mi. free zone

>15-30 mi. base pay + $1.00/hr

>30-50 mi. base pay + $1.50/hr

>50 mi. base pay + $2.00/hr

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-50 mi. $20/day

>50 mi. $30/day

Districts 7-10

0-30 mi. free zone

>30-60 mi. base pay + $3.70/hr

>60 mi. base pay + $5.60/hr

Duties Include:

Install roll and batt insulation.

District 3

0-30 mi. free zone

>30-50 mi. $18/day

>50 mi. $25/day

CEMENT MASONS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$18.33

$18.33

$20.24

$18.33

$18.33

$18.33

$18.33

$16.00

$18.33

$18.33

Benefit

$7.96

$7.96

$7.96

$7.96

$7.96

$7.96

$7.96

$6.80

$7.96

$7.96

Districts 3-10

0-30 mi. free zone

>30-60 mi. base pay + $2.95/hr

>60 mi. base pay + $4.75/hr

Duties Include:

Smooth and finish surfaces of poured concrete,

such as floors, walks, sidewalks, or curbs. Align

forms for sidewalks, curbs, or gutters.

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-60 mi. base pay + $1.05/hr

>60 mi. base pay + $1.50/hr

BUILDING CONSTRUCTION SERVICES 2011

Page 2

EFFECTIVE JANUARY 27, 2011

�CONSTRUCTION EQUIPMENT OPERATORS GROUP 2

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$23.94

$23.94

$23.94

$23.94

$23.94

$23.94

$23.94

$23.94

$23.94

$23.94

Benefit

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

This group includes but is not limited to:

Air Doctor; Backhoe\Excavator\Shovel, to and incl.

3 cu.yds; Bit Grinder; Bituminous Paving Travel

Plant; Boring Machine, Large; Broom, SelfPropelled; Concrete Travel Batcher; Concrete Float

& Spreader; Concrete Bucket Dispatcher; Concrete

Finish Machine; Concrete Conveyor; Distributor;

Dozer, Rubber-Tired, Push, & Side Boom;

Elevating Grader\Gradall; Field Equipment

Serviceman; Front-End Loader, 1 cu.yd to and inc.

5 cu. yds; Grade Setter; Heavy Duty Drills, All

Types; Hoist\Tugger, All; Hydralift Forklifts &

Similar; Industrial Locomotive; Motor Patrol (except

finish); Mountain Skidder; Oiler, Cranes\Shovels;

Pavement Breaker, EMSCO; Power Saw, SelfPropelled; Pugmill; Pumpcrete\Grout Machine;

Punch Truck; Roller, other than Asphalt; Roller,

Sheepsfoot (Self-Propelled); Roller, 25 tons and

over; Ross Carrier; Rotomill, under 6 ft; Trenching

Machine; Washing /Screening Plant.

Travel:

All Districts

0-30 mi. free zone

>30-60 mi. base pay + $3.50/hr

>60 mi. base pay + $5.50/hr

CONSTRUCTION EQUIPMENT OPERATORS GROUP 3

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$24.34

$24.34

$24.34

$24.34

$24.34

$24.34

$24.34

$24.34

$24.34

$24.34

This group includes but is not limited to:

Asphalt Paving Machine; Asphalt Screed;

Backhoe\Excavator\Shovel, over 3 cu. yds;

Cableway Highline; Concrete Batch Plant; Concrete

Curing Machine; Concrete Pump; Cranes, Creter;

Cranes, Electric Overhead; Cranes, 24 tons and

under; Curb Machine\Slip Form Paver; Finish

Dozer; Front-End Loader, over 5 cu. yds;

Mechanic\Welder; Pioneer Dozer; Roller Asphalt

(Breakdown & Finish); Rotomill, over 6 ft; Scraper,

Single, Twin, or Pulling Belly-Dump; YO-YO Cat.

Benefit

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

Travel:

All Districts

0-30 mi. free zone

>30-60 mi. base pay + $3.50/hr

>60 mi. base pay + $5.50/hr

BUILDING CONSTRUCTION SERVICES 2011

Page 3

EFFECTIVE JANUARY 27, 2011

�CONSTRUCTION EQUIPMENT OPERATORS GROUP 4

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$25.00

$25.00

$25.00

$25.00

$25.00

$25.00

$25.00

$25.00

$25.00

$25.00

Benefit

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

Travel:

All Districts

0-30 mi. free zone

>30-60 mi. base pay + $3.50/hr

>60 mi. base pay + $5.50/hr

This group includes but is not limited to:

Asphalt\Hot Plant Operator; Cranes, 25 tons to and

incl. 44 tons; Crusher Operator; Finish Motor Patrol;

Finish Scraper.

CONSTRUCTION EQUIPMENT OPERATORS GROUP 5

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$25.50

$25.50

$25.50

$25.50

$25.50

$25.50

$25.50

$25.50

$25.50

$25.50

Benefit

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

Travel:

All Districts

>0-30 mi. free zone

>30-60 mi. base pay + $3.50/hr

>60 mi. base pay + $5.50/hr

This group includes but is not limited to:

Cranes, 45 tons to and incl.74 tons.

CONSTRUCTION EQUIPMENT OPERATORS GROUP 6

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$26.60

$26.60

$26.60

$26.60

$26.60

$26.60

$26.60

$26.60

$26.60

$26.60

Benefit

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

BUILDING CONSTRUCTION SERVICES 2011

Travel:

All Districts

0-30 mi. free zone

>30-60 mi. base pay + $3.50/hr

>60 mi. base pay + $5.50/hr

This group includes but is not limited to:

Cranes, 75 tons to and incl.149 tons; Cranes,

Whirley (All).

Page 4

EFFECTIVE JANUARY 27, 2011

�CONSTRUCTION EQUIPMENT OPERATORS GROUP 7

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$27.10

$27.10

$27.10

$27.10

$27.10

$27.10

$27.10

$27.10

$27.10

$27.10

Benefit

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

$9.50

Travel:

All Districts

0-30 mi. free zone

>30-60 mi. base pay + $3.50/hr

>60 mi. base pay + $5.50/hr

This group includes but is not limited to:

Cranes, 150 tons to and incl. 250 tons; Cranes,

over 250 tons—add $1.00 for every 100 tons over

250 tons; Crane, Tower (All); Crane Stiff-Leg or

Derrick; Helicopter Hoist.

CONSTRUCTION LABORERS GROUP 1

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$18.88

$18.88

$16.30

$16.30

$16.30

$16.30

$16.30

$16.30

$16.30

$16.30

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-60 mi. base pay + $1.50/hr

>60 mi. base pay + $2.00/hr

Benefit

$7.27

$7.27

$6.52

$6.52

$6.52

$6.52

$6.52

$6.52

$6.52

$6.52

District 3-10

0-15 mi. free zone

>15-30 mi. base pay + $0.65/hr

>30-50 mi. base pay + $0.85/hr

>50 mi. base pay + $1.25/hr

Occupation:

Flagpersons

BUILDING CONSTRUCTION SERVICES 2011

Page 5

EFFECTIVE JANUARY 27, 2011

�CONSTRUCTION LABORERS GROUP 2

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$19.13

$18.03

$17.43

$17.25

$17.59

$18.19

$17.52

$14.68

$17.25

$14.31

Benefit

$3.24

$4.44

$5.41

$6.52

$6.51

$6.84

$6.52

$4.50

$2.66

$5.69

District 5

0-15 mi. free zone

>15-30 mi. base pay + $0.9./hr

>30-50 mi. base pay + $1.31/hr

>50 mi. base pay + $2.09/hr

Districts 4, 7-10

0-15 mi. free zone

>15-30 mi. base pay + $0.65/hr

>30-50 mi. base pay + $0.85/hr

>50 mi. base pay + $1.25/hr

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-60 mi. base pay + $1.50/hr

>60 mi. base pay + $2.00/hr

This group includes but is not limited to:

General Labor; Asbestos Removal; Burning Bar;

Bucket Man; Carpenter Tender; Caisson Worker;

Cement Mason Tender; Cement Handler (dry);

Chuck Tender; Choker Setter; Concrete Worker;

Curb Machine-lay Down; Crusher and Batch

Worker; Heater Tender; Fence Erector; Landscape

Laborer; Landscaper; Lawn Sprinkler Installer; Pipe

Wrapper; Pot Tender; Powderman Tender; Rail and

Truck Loaders and Unloaders; Riprapper; Sign

Erection; Guardrail and Jersey Rail; Spike Driver;

Stake Jumper; Signalman; Tail Hoseman; Tool

Checker and Houseman and Traffic Control

Worker.

District 3 & 6

0-15 mi. free zone

>15-30 mi. base pay + $0.65/hr

>30-50 mi. base pay + $0.75/hr

>50 mi. base pay + $1.25/hr

CONSTRUCTION LABORERS GROUP 3

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$19.28

$19.28

$18.14

$17.30

$18.14

$18.13

$17.30

$17.30

$17.30

$17.30

Benefit

$7.27

$7.27

$7.55

$6.52

$7.55

$5.90

$6.52

$6.52

$6.52

$6.52

Districts 3, 5, 6

0-15 mi. free zone

>15-30 mi. base pay + $0.93/hr

>30-50 mi. base pay + $1.31/hr

>50 mi. base pay + $2.09/hr

District 4, 7-10

0-15 mi. free zone

>15-30 mi. base pay + $0.65/hr

>30-50 mi. base pay + $0.85/hr

>50 mi. base pay + $1.25/hr

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-60 mi. base pay + $1.50/hr

>60 mi. base pay + $2.00/hr

BUILDING CONSTRUCTION SERVICES 2011

This group includes but is not limited to:

Concrete Vibrator; Dumpman (Grademan);

Equipment Handler; Geotextile and Liners; HighPressure Nozzleman; Jackhammer (Pavement

Breaker) Non-Riding Rollers; Pipelayer; Posthole

Digger (Power); Power Driven Wheelbarrow;

Rigger; Sandblaster; Sod Cutter-Power and

Tamper.

Page 6

EFFECTIVE JANUARY 27, 2011

�CONSTRUCTION LABORERS GROUP 4

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$22.48

$18.89

$18.86

$17.35

$18.86

$18.86

$17.35

$17.35

$17.35

$17.35

Benefit

$7.27

$7.27

$7.55

$6.52

$7.55

$6.22

$6.52

$6.52

$6.52

$6.52

District 4, 7-10

0-15 mi. free zone

>15-30 mi. base pay + $0.65/hr

>30-50 mi. base pay + $0.85/hr

>50 mi. base pay + $1.25/hr

This group includes but is not limited to:

Hod Carrier***; Water Well Laborer; Blaster; Wagon

Driller; Asphalt Raker; Cutting Torch; Grade Setter;

High-Scaler; Power Saws (Faller & Concrete)

Powderman; Rock & Core Drill; Track or Truck

Mounted Wagon Drill and Welder including Air Arc.

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-60 mi. base pay + $1.50/hr

>60 mi. base pay + $2.00/hr

Note: ***Hod Carriers will receive the same amount

of travel and/or subsistence pay as bricklayers

when requested to travel.

Districts 3, 5, 6

>0-15 mi. free zone

>15-30 mi. base pay + $0.93/hr

>30-50 mi. base pay + $1.31/hr

>50 mi. base pay + $2.09/hr

DRYWALL APPLICATORS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$20.90

$20.90

$24.00

$16.46

$19.25

$19.25

$19.74

$16.06

$19.74

$19.74

Benefit

$ 5.61

$10.06

$ 7.90

$ 7.85

$ 9.45

$ 9.45

$ 9.09

$ 9.09

$ 9.09

$ 9.09

District 4

0-15 mi. free zone

>15-30 mi. base pay + $2.50/hr

>30-50 mi. base pay + $3.75/hr

>50 mi. base pay + $6.25/hr

Districts 5 & 6

0-15 mi. free zone

>15-30 mi. base pay + $1.00/hr

>30-50 mi. base pay + $1.50/hr

>50 mi. base pay + $2.00/hr

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-50 mi. $20/day

>50 mi. $30/day

Districts 7-10

0-30 mi. free zone

>30-60 mi. base pay + $3.70/hr

>60 mi. base pay + $5.60/hr

Duties Include:

Drywall and ceiling tile installation.

District 3

0-30 mi. free zone

>30-50 mi. $18/day

>50 mi. $25/day

BUILDING CONSTRUCTION SERVICES 2011

Page 7

EFFECTIVE JANUARY 27, 2011

�ELECTRICIANS (INCLUDING BUILDING AUTOMATION CONTROL)

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$27.02

$26.39

$26.80

$28.26

$28.26

$26.61

$28.26

$29.38

$29.38

$29.38

Benefit

$10.37

$ 4.88

$10.59

$ 9.15

$ 9.15

$ 9.20

$ 9.15

$ 9.88

$ 9.88

$ 9.88

Districts 4, 5, 7

0-8 mi. free zone

>8-50 mi. current federal mileage rate/mi.

>50 mi. $55/day

District 6

0-18 mi. free zone

>18-60 mi. current federal mileage rate/mi.

>60 mi. $65/day

Big Sky and West Yellowstone $75/day

Districts 8, 9, 10

0-18 mi. free zone

>18-60 mi. current federal mileage rate/mi.

>60 mi. $75/day

Travel:

Districts 1 & 2

0-10 mi. free zone

>10-45 mi. $0.585/mi.

>45 mi. $65/day

Duties Include:

Electrical wiring; equipment and fixtures; street

lights; electrical control systems. . Installation

and/or adjusting of building automation controls

also during testing and balancing, commissioning

and retro-commissioning.

District 3

0-10 mi. free zone

>10-55 mi. current federal mileage rate/mi.

>55 mi. $60/day + current federal mileage rate/mi.

ELEVATOR CONSTRUCTORS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$44.14

$44.14

$44.14

$44.14

$44.14

$44.14

$44.14

$44.14

$44.14

$44.14

Benefit

$24.98

$24.98

$24.98

$24.98

$24.98

$24.98

$24.98

$24.98

$24.98

$24.98

BUILDING CONSTRUCTION SERVICES 2011

Travel:

All Districts

0-15 mi. free zone

>15-25 mi. $35.27/day

>25-35 mi. $70.54/day

>35 mi. $72.55/day + $0.66/mi.

Page 8

EFFECTIVE JANUARY 27, 2011

�FLOOR LAYERS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$17.35

$17.35

$20.00

$17.35

$17.35

$20.00

$20.00

$20.00

$17.35

$20.00

Benefit

$6.23

$6.23

$8.18

$6.23

$6.23

$8.18

$8.18

$8.18

$6.23

$8.18

Travel:

All Districts

0-10 mi. free zone

>10 mi. $0.40/mi.

Wage

$17.35

$15.13

$20.00

$17.35

$15.65

$19.32

$20.00

$15.53

$16.95

$17.46

Benefit

$2.85

$6.23

$8.18

$6.23

$0.70

$3.47

$8.18

$2.56

$6.23

$8.11

Travel:

All Districts

0-10 mi. free zone

>10 mi. $0.40/mi.

Per Diem:

All Districts

$32/day

Duties Include:

Apply blocks, strips, or sheets of shock-absorbing,

sound-deadening, or decorative coverings to floors,

including carpets. Scrap, sand, and apply of coats

of finish to wooden floors.

GLAZIERS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Per Diem:

All Districts

$32/day

INSULATION WORKERS-MECHANICAL (HEAT AND FROST)

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$25.74

$25.74

$25.74

$25.74

$25.74

$25.74

$25.74

$25.74

$25.74

$25.74

Benefit

$13.80

$13.80

$13.80

$13.80

$13.80

$13.80

$13.80

$13.80

$13.80

$13.80

Travel:

All Districts

0-30 mi. free zone

>30-40 mi. $16.50/day

>40-50 mi. $21/day

>50-60 mi. $26.50/day

>60 mi. $37.50/day

Per Diem:

All Districts

$65/day + $0.40/mi

Duties Include:

Insulate pipes, ductwork or other mechanical

systems.

BUILDING CONSTRUCTION SERVICES 2011

Page 9

EFFECTIVE JANUARY 27, 2011

�IRONWORKERS-STRUCTURAL STEEL AND REBAR PLACERS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$25.34

$25.34

$25.30

$25.30

$25.30

$25.30

$25.30

$25.30

$25.30

$25.30

Benefit

$16.58

$16.58

$16.31

$16.31

$16.31

$16.31

$16.31

$16.31

$16.31

$16.31

Districts 3-10

0-45 mi. free zone

>45-85 mi. $45/day

>85 mi. $75/day

Benefit

$10.06

$10.06

$ 9.09

$ 9.09

$ 9.09

$ 9.09

$ 9.09

$ 9.09

$ 9.09

$ 9.09

District 4

0-15 mi. free zone

>15-30 mi. base pay + $2.50/hr

>30-50 mi. base pay + $3.75/hr

>50 mi. base pay + $6.25/hr

Duties Include:

Structural steel erection; assemble prefabricated

metal buildings; cut, bend, tie, and place rebar;

energy producing windmill type towers; metal

bleacher seating; handrail fabrication and

ornamental steel.

Travel:

Districts 1 & 2

0-45 mi. free zone

>45-60 mi. $30/day

>60-100 mi. $55/day

>100 mi. $75/day + $0.50/mi.

MILLWRIGHTS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$24.90

$24.90

$23.74

$23.74

$23.74

$23.74

$23.74

$23.74

$23.74

$23.74

Districts 5 & 6

0-15 mi. free zone

>15-30 mi. base pay + $1.00/hr

>30-50 mi. base pay + $1.50/hr

>50 mi. base pay + $2.00/hr

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-50 mi. $20/day

>50 mi. $30/day

Districts 7-10

0-30 mi. free zone

>30-60 mi. base pay + $3.70/hr

>60 mi. base pay + $5.60/hr

District 3

0-30 mi. free zone

>30-50 mi. $18/day

>50 mi. $25/day

BUILDING CONSTRUCTION SERVICES 2011

Page 10

EFFECTIVE JANUARY 27, 2011

�PAINTERS (Including Paperhanger)

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$16.80

$17.27

$20.00

$17.35

$17.35

$18.00

$20.00

$16.25

$14.40

$14.40

Benefit

$1.82

$6.23

$8.18

$6.23

$6.23

$2.20

$8.18

$2.00

$6.23

$6.23

Travel:

All Districts

0-10 mi. free zone

>10 mi. $0.40/mi.

Benefit

$ 9.09

$10.06

$ 7.90

$ 9.09

$ 9.09

$ 9.09

$ 9.09

$ 9.09

$ 9.09

$ 9.09

District 4

0-15 mi. free zone

>15-30 mi. base pay + $2.50/hr

>30-50 mi. base pay + $3.75/hr

>50 mi. base pay + $6.25/hr

Per Diem:

All Districts

$32/day

PILE BUCKS

District 1

District 2

District 3

District 4

District 5

District 6

District 7

District 8

District 9

District 10

Wage

$19.99

$20.45

$24.50

$19.99

$19.99

$19.99

$19.99

$19.99

$19.99

$19.99

Districts 5 & 6

0-15 mi. free zone

>15-30 mi. base pay + $1.00/hr

>30-50 mi. base pay + $1.50/hr

>50 mi. base pay + $2.00/hr

Travel:

Districts 1 & 2

0-30 mi. free zone

>30-50 mi. $20/day

>50 mi. $30/day

Districts 7-10

0-30 mi. free zone

>30-60 mi. base pay + $3.70/hr

>60 mi. base pay + $5.60/hr

Duties Include: