This text is machine-read, and may contain errors. Check the original document to verify accuracy.

form 10-k.htm

Page 78 of 112

In 2008, the Company entered into an amended agreement with the previous stockholder of Syscon to amend the Syscon

Purchase Agreement. Pursuant to the new agreement, the fonner stockholder's Employment Agreement with Syscon was

terminated and Syscon entered into a Consulting Agreement with a company controlled by the former owner. The Consulting

Agreement covers certain management and advisory and other services to be provided over a period of three years, for which

Syscon will pay a total of approximately $1,090,000 in fees. In 2008, the Company paid $0.5 million to an affiliate of the

former stockholder for professional software development consulting services. In 2009, the Company paid $0.2 million to the

former stockholder related to the provisions of the Consulting Agreement.

•

(lO)COMMITMENTS AND CONTINGENCIES

(a) Operating Leases

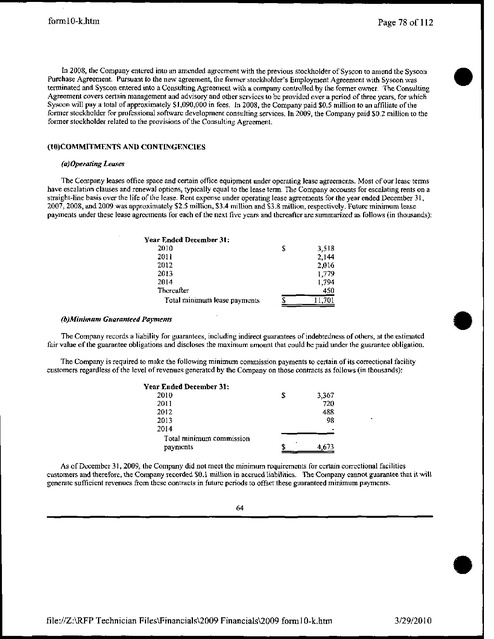

The Company leases office space and certain office equipment under operating lease agreements. Most of our lease tenns

have escalation clauses and renewal options, typically equal to the lease tenn. The Company accounts for escalating rents on a

straight-line basis over the life of the lease. Rent expense WIder operating lease agreements for the year ended December 31,

2007,2008, and 2009 was approx.imately $2.5 million, $3.4 mimon and $3.8 million, respectively. Future minimum lease

payments under these lease agreements for each of the next five years and thereafter are summarized as follows (in thousands):

Year Ended December 31:

2010

$

20ll

2012

2013

2014

Thereafter

Total minimum lease payments

$

3,518

2,144

2,016

1,779

1,794

450

11,701

(b)Minimum Guaranteed Payments

The Company records a liability for guarantees, including indirect guarantees of indebtedness of others, at the estimated

fair value of the guarantee obligations and discloses the maximum amount that could be paid under the guarantee obligation.

•

The Company is required to make the following minimum commission payments to certain of its correctional facility

customers regardless of the level of revenues generated by the Company on those contracts as follows (in thousands):

Year Euded December 31:

2010

2011

2012

2013

2014

Total minimum commission

payments

$

3,367

720

488

98

$

4,673

As of December 31, 2009, the Company did not meet the minimum requirements for certain correctional facilities

customers and therefore, the Company recorded $0.1 million in accrued liabilities. The Company cannot guarantee that it will

generate sufficient revenues from these contracts in future periods to offset these guaranteed minimum payments.

64

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 form! O-k.htm

312912010

�fonn 1O-khtm

•

Page 79 of 112

Accudata Technologies, a fonner affiliated company, provides validation services to the Company. In August 2007,

Accudata purchased the Company's 50% interest in its preferred stock for $1.0 million. In connection with the sale of our

interest in Accudata, the Company agreed to continue to conduct business at market rates with Accudata for at least thirty-six

months. Minimum monthly payments for validation services are $S5,000 for the first twelve months, $56,667 for the second

twelve months, and $28,333 for the third twelve months. The Company paid Accudata $1:0 million and $0.7 million for the

twelve months ended December 31, 2008 and 2009, respectively. The maximum amount of the commitment is $2.0 million, of

which $1.8 million has been paid as of December 31,2009.

In 200S, the Company entered into an agreement with a telecommunications vendor, primarily for local and long distance

services, whereby the Company guaranteed a minimum annual purchase commitment over a three year period. As of

December 31,2009, the minimum purchase commitment is $1.9 million annually. Additionally, the Company entered into an

agreement with another telecommunications provider for the purchase of custom carrier services, whereby the Company

guaranteed a minimum purchase commitment over a one year period. The Company satisfied the minimum purchase

commitment of$3.S million during 2009.

(c)Employment Agreements

As of December 31,2009, the Company had employment agreements with certain key management personnel, which

provided for minimum compensation levels and incentive bonuses along with provisions for termination of benefits in certain

circumstances and for certain severance payments in the event of a change in control (as defined).

(d)Litigation

We have been, and expect to continue to be, subject to various legal and administrative proceedings or various claims in

the normal course of business. We believe the ultimate disposition of these matters will not have a material effect on our

financial condition, liquidity, or results of operations.

•

From time to time, inmate telecommunications providers, including the Company, are parties to judicial and regulatory

complaints and proceedings initiated by inmates, consumer protection advocates or individual called parties alleging, among

other things, that excessive rates are being charged witb respect to inmate collect calls, that commissions paid by inmate

telephone service providers to the correctional facilities are too higb, that a call was wrongfully disconnected, that security

notices played during the call disrupt the call, that the billed party did not accept the collect calls for which they were billed or

that rate disclosure was not provided or was inadequate. On occasion, we are also the subject of regulatory complaints

regarding our compliance with various matters including tariffing, access charges, payphone compensation requirements and

rate disclosure issues. In March 2007, the FCC asked for public comment on a proposal from an inmate advocacy group to

impose a federal rate cap on interstate inmate calls. This proceeding could have a significant impact on the rates that we and

other companies in the inmate telecommunications industry may charge. Similar proposals have been pending before the FCC

for more than four years without action by the agency. This newest proceeding remains under review by the FCC and has

received strong opposition from the inmate telecommunications industry. In August 2008, a group of inmate telephone service

providers provided the FCC with an "industry wide" cost of service study for their consideration. That proceeding remains

ongoing and we have no infonnation as to when, if ever, it will be resolved. We cannot predict the outcome at this time.

In June 2000, T-Netix was named, along with AT&T, in a lawsuit in the Superior Court of King County, Washington, in

which two private citizens allege violations of state rules requiring pre-connect audible disclosure of rates as required by

Washington statutes and regulations. T-Netix and other defendants successfully obtained dismissal and a "primary

jurisdiction" referral in 2002. In 2005, after several years of inactivity before the Washington Utilities and Transportation

Commission ("WUTC"), the state telecommunications regulatory agency, T-Netix prevailed at the trial court in securing an

order entering summary judgment on grounds oflack of standing, but that decision was reversed by an intermediate

Washington state appellate court in December 2006. T -Netix's subsequent petition for review by the Washington Supreme

Court was denied in January 2008, entitling plaintiffs to continue to pursue their claims against T-Netix and AT&T. This

matter was referred to the WUTC on the grounds of primary jurisdiction, in order for the WUTC to determine various

regulatory issues. On May 22,2008, AT&T filed with the trial court a cross-claim against T-Netix seeking indemnification. TNeti" moved to dismiss AT&T's cross-claim, but the court denied that motion and deferred resolution of whether

AT&T's belated indemnification claim is within the statute oflimitations for summary judgment. Motions by both T -Netix

and AT&T for summary determination were briefed to the WUTC in September 2009 and remain pending before an

administrative law judge. As merits and damages discovery are not completed, however, we cannot estimate the Company's

potential exposure or predict the outcome of this dispute.

•

In July 2009, Evercom filed a complaint against Combined Public Communications, Inc. (~CPC"), alleging tortious

interference with Evercom's contracts for the provision of telecommunications services with correctional facilities in the

Commonwealth of Kentucky and the State ofIndiana. Evercom claims CPC has misrepresented that the correctional facility

file:I/Z:\RFP Technician Files\Financials\2009 Financials\2009 {onnlO-khtm

3129/2010

�form 1O-k.htm

Page 80 of 112

has a statutory right to terminate its contract with Evercorn upon the election ofa new Sheriff. Accordingly, Evercom

seeks a declaration that under Kentucky law its contracts with its customers are not personal services contracts and that under

both Indiana and Kentucky law, its contracts with correctional facilities are not void for not being terminable within thirty

days, as well as an award of compensatory and punitive damages. On July 29, 2009, CPC filed a motion to dismiss for failure

to state a c1aim. On August 14,2009, Evercom filed its response in opposition to dismiss, and on September 9, 2009, the court

denied CPC's motion to dismiss. On January 8, 2009, the court entered a scheduling order setting forth the pre-trial

deadlines. This matter is in its early stages and we cannot predict the outcome at this time.

•

65

•

•

file://Z:\RFP Technician Files\Financials\2009 Financials\2009 fonnlO-k.htm

3/2912010

�form 1O-k.htm

•

Page 81 of 112

In July 2009, the Company filed a petition with the FCC seeking affinnation of the Company's right to block attempts by

inmates to use services, which the Company calls "call diversion schemes," designed to circumvent its secure calling

platforms. These illicit services are not pennitted to carry calls from any correctional facility, and the Company has received

strong support from its correctional authority clients to stop this activity. The FCC has long-standing precedent that permits

inmate telecommunications service providers to block such attempts. The FCC had asked that interested parties file comments

to the Company's petition by August 31 , 2009; and thereafter, the Company filed reply comments. This matter is in its early

stages and we cannot predict the outcome at this time.

In September 2009, T-Netix filed suit against CPC in the United States Federal District Court for the Western District of

Kentucky, for patent infringement of various T-Netil!. patents. The court has scheduled a Rule 26(f) scheduling conference for

February 10, 2010 and the parties are negotiating an agreed discovery plan to present at the hearing. This matter is in its early

stages and we cannot predict the outcome at this time.

In October 2009, T-Netil!. filed suit in the United States Federal District Court for the Eastern District of Texas against

Pinnacle Public Services, LLC for patent infringement of various T -Netix patents. Pinnacle has served its answer and filed a

motion to transfer venue to the Northern District of Texas. This matter is in its early stages and we cannot predict the outcome

at this time.

In October 2009, the Company, along with Evercom and T-Netix, and one of the Company's competitors were sued in the

Federal District Court for the Southern District of Florida by Millicorp d/b/a ConsCallHome. Millicorp, a proprietor of what

the Company has described to the FCC as a call diverter, has sued these companies under the Communications Act of 1934,

alleging that the companies have no right to block attempts by inmates to use the call diversion scheme. The FCC has

pennitted inmate telecommunications service providers to block such attempts since 1991, and the Company had sought reaffirmance of that pennission in the petition for declaratory ruling described above. All defendants have filed motions to

dismiss all claims with prejudice. Discovery has not yet commenced. This matter is in its early stages and we cannot predict

the outcome at this time.

•

In October 2009, the Company filed suit in the District Court of Dallas County, Texas, against Lattice Incorporated

("Lattice", formerly known as Science Dynamics Corporation) alleging breach of contract, tortious interference, unfair

competition, damage to goodwill and injunctive relief as a result of Lattice's breach of certain provisions of a December 2003

asset purchase agreement between Evercom and Science Dynamics Corporation. On October 2, 2009, the court issued a

temporary restraining order against Lattice, and ordered Lattice to immediately cease and desist from, among other things, (i)

renewing any customer contracts in the law enforcement industry; (ii) marketing, selling or soliciting, directly or indirectly,

any of its products and/or services to any customers in the law enforcement industry; and (iii) interfering with any of the

Company's business relationships in the law enforcement industry in the United States. On January 4,2010, the parties

entered into a settlement agreement and mutual release, and a patent license agreement wherein Lattice was granted a license

to use one (1) of the Company's patents.

In January 2010, T -Netix and Evercom filed suit in the United States Federal District Court for the Eastern District of

Texas against Legacy Long Distance International, Inc. dba Legacy International, Inc. and Legacy Inmate Conununications for

patent infringement of various T-Netix's and Evercom's patents. This matter is in its early stages and we cannot predict the

outcome at this time.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

During fiscal year 2009, the Company dismissed KPMG LLP ("KPMG") as its principal accountant to audit its financial

statements. The Audit Committee of the board of directors of the Company approved the change in principal accountants. In

April 2009, the Company engaged McGladrey & Pullen, LLP ("McGladrey") as its principal accountant to audit the

Company's financial statements. During the two most recent fiscal years ended December 31,2008 and the subsequent interim

period in 2009, the Company had not consulted with McGladrey regarding any of the following: (1) the application of

accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be

rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company

that McGladrey concluded was an important factor considered by the Company in reaching a decision as to the accounting,

auditing or financial reporting issue, or (2) any matter that was either the subject of a disagreement (as defined in paragraph

304(a)(1 )(iv) and tbe related instructions to Item 304 of Regulation S-K) or a reportable event (as defined in ltem 304(a)(1 }(v)

of Regulation S-K).

•

During the two most recent fiscal years ended December 31, 2008 and the subsequent interim period in 2009, there were

no disagreements between KPMG and the Company on any matter of accounting principles or practices, financial statement

disclosure, or auditing scope or procedure which, if not resolved to the satisfaction ofKPMG, would have caused it to make a

file:/IZ:\RFP Technician Files\Financials\2009 Financials\2009 form 1O-k.htm

3/29/2010

�form I 0-k.htm

Page 82 of 112

reference to the subject matter of any such disagreement with its report. No reportable events, as defined in Item 304(a)(1)

(v) of Regulation S-K, occurred within the Company's two most recent fiscal years ended December 31, 2008 and the

subsequent interim period in 2009.

•

66

•

•

fiJe:IIZ:\RFP Technician FiJes\FinanciaJs\2009 Financials\2009 formlO-k.htm

312912010

�Page 83 of 112

formlO-k.htm

•

ITEM 9A. CONTROLS AND PROCEDURES

1, Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in

the reports that we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported

within the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is

accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as

appropriate to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report, we earned out an evaluation, under the supervision and with the

participation of our Disclosure Committee and management, including the Chief Executive Officer and the Chief Financial

Officer, of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Exchange Act

Rule 13a-15 (b). Based upon this evaluation, the Chief Executive Officer and the Chief Financial Officer concluded that our

disclosure controls and procedures were effective as of the end of the period covered by this report.

2. Management's Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as

defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. Our internal control over financial

reporting is a process designed under the supervision of our Chief Executive Officer and Chief Financial Officer to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external

purposes in accordance with U.S. generally accepted accounting principles.

•

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate

because of changes in conditions, or that the degree of compliance with policies and procedures may deteriorate.

Management assessed the effectiveness of our internal control over financial reporting as of December 31, 2009. In

making this assessment, management used the criteria described in Internal C()ntr()/- Integrated Framework issued by the

Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on this assessment, management

concluded that we maintained effective internal control over financial reporting as of December 31, 2009.

The effectiveness of the Company's internal control over financial reporting as of December 31, 2009 has been audited by

an independent registered public accounting firm, as stated in their report which appears herein.

3. Changes in Internal Control over Financial Reporting

There were no changes in the Company's internal control over financial reporting during the period ended December 31,

2009, that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial

reporting.

67

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 formIO-k.htm

3129/2010

�formlO-k.htm

Page 84 of 112

Report oflndependent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Securus Technologies, Inc.

We have audited Securus Technologies, Inc. and Subsidiaries' internal control Over financial reporting as of December 31,

2009, based on criteria established in Internal Control- Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission. Securus Technologies, Inc. and Subsidiaries' management is responsible for

maintaining effective internal control over financial reporting and for its assessment of the effectiveness ofintemal control

over financial reporting included in the accompanying Management's Report on Internal Control over Financial

Reporting. Our responsibility is to express an opinion on the company's internal control over financial reporting based on our

audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United

States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective

internal control over financial reporting was maintained in a11 material respects. Our audit included obtaining an

understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and

evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included

performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a

reasonable basi.s for our opinion.

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial statements for external purposes in accordance with United

States generally accepted accou.nting principles. A company's internal control Over financial reporting inclu.des those policies

and procedures that (a) pertain to the maintenance ofrecords that, in reasonable detail, accurately and fairly reflect the

transactions and dispositions of the assets of the company; (b) provide reasonable assurance that transactions are recorded as

necessary to permit preparation of financial statements in accordance with United States generally accepted accounting

principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of

management and directors of the company; and (c) provide reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial

statements.

•

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate

because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, Securus Technologies, lnc. and Subsidiaries maintained, in all material respects, effective internal control over

financial reporting as of December 31,2009, based on criteria established in Internal Control- Integrated Framework issued

by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States),

the December 31,2009 consolidated balance sheet and the related consolidated statements of operations, stockholders' deficit

and comprehensive loss, and cash flows for the year then ended of Securus Technologies, Inc. and Subsidiaries and our report

dated March 15,2010 expressed an unqualified opinion.

McGladrey & Pullen, LLP

Dallas, Texas

March 15,2010

68

•

file://Z:\RFP Technician Files\Financials\2009 Financials\2009 formlO-k.htm

3129/2010

�Page 85 of112

formlO~k.htm

•

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORA TION GOVERNANCE

The following is a list of our executive officers, other senior executives and directors as of March 1, 2010. All of our

directors serve until a successor is duly elected and qualified or until the earlier of his death, resignation or removal. Our

executive officers are appointed by and serve at the discretion of our board of directors. There are no family relationships

between any of our directors or executive officers.

Name

Richard A. Smith

William D. Markert

Dennis J. Reinhold

Arlin B. Goldberg

Robert E. Pickens

Daniel A. Crawford

Joshua E. Conklin

Danny de Hoyos

Kathryn S. Lengyel

Larry V. Ehlers

Patrick W. Brolsma

•

Anthony A. Tamer

Brian D. Schwartz

Douglas F. Bennan

Lewis 1. Schoenwetter

SamiW. Mnayrnneh

James Neal Thomas (l)

Rob Wolfson

(I)

AlJe

Position

~~----~~~--.--~~~~~----------------58

Chainnan, Chief Executive Officer and President

45

Chief Financial Officer

49 Vice President, General Counsel and Secretary

53

Chief Infonnation Officer

49

Chief Marketing Officer

63

President, Syscon Justice Systems

35

Vice President, Sales

34

Vice President Service and Technical Operations

41

Vice President, Human Resources

55

Vice President, Applications

47 Director ofEntetprise Program Management Office & Corporate

Development

49 Director

41

Director

43

Director

39 Director

50 Director

64 Director

37 Director

Audit Oversight Director.

The following infonnation summarizes the principal occupations and business experience, during the past five years, of

each of our directors and executive officers.

Richard A. Smith has served as our President and Chief Executive Officer since June 2008, and as Chainnan of the Board

since January 2009. Mr. Smith served as the Chief Executive Officer of Eschelon Telecom Inc., a publicly traded local

exchange carrier, from August 2003 through August 2007. Mr. Smith also served as Eschelon's President, Chief Financial

Officer and Chief Operating Officer during his tenure. Prior to joining Eschelon, Mr. Smith worked for Frontier Corporation

where he held many roles, including Controller, Chief Infonnation Officer, President of Frontier Infonnation Technologies,

Vice President of Midwest Telephone Operations, Network Plant Operations Director, Director of Business Development and

Vice President of Financial Management. Mr. Smith holds an Associate Degree of Applied Science in Electrical Engineering

from the Rochester Institute of Technology, a Bachelor of Science degree in Electrical Engineering from the State University

of New York at Buffalo, a Masters in Mathematics degree from the State University of New York at Brockport, and a Masters

in Business Administration from the University of Rochester's Simon School. Mr. Smith presently serves as a director of

Integra Telecom, a privately held local exchange carrier based in Portland, Oregon.

•

William D. Markert has served as our Chief Financial Officer since June 2008. From December 1999 to November 2007,

Mr. Markert held executive level finance positions at Eschelon Telecom, Inc., with his most recent position being Executive

Vice President of Network Finance. During Mr. Markert's employment with Eschelon, he was responsible for revenue and

cost accounting and reporting, network cost management, carrier access billing and revenue and margin assurance. He also

directed various merger and acquisition related projects. Prior to joining Eschelon, Mr. Markert worked for Global Crossing

Limited, a publicly traded communications solutions company, in various financial, regulatory and operational management

roles. Mr. Markert holds a Baccalaureate in Business Administration from the University of Wisconsin-Whitewater and a

Masters in Business Administration from the University of St. Thomas in St. Paul, Minnesota.

69

file://Z:\RFP Technician Files\Financials\2009 Financials\2009 formlO-k.htm

3/29/2010

�formlO-k.htm

Page 86 of 112

.

'

•

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 fonnl0-k.htm

3/29/2010

�form 1O~k.htm

•

Page 87 of 112

Dennis J. Reinhold has served as our Vice President, General Counsel and Secretary since he joined us in August 2005.

Prior to joining us in August 2005, Mr. Reinhold served as the Associate General Counsel of SOURCE CORP, Inc.

(NASDAQ: SRCP), at the time a public company with approximately 7,000 employees worldwide that specialized in business

process outsourcing of critical data and documents. In that role, he was responsible for the worldwide legal function of the

Business Process Solutions Division, the Statement Solutions Division, the Legal Claims Division and the Direct Mail

Division. While at SOURCECORP, he was the company's Chairman of the Juvenile Diabetes Research Foundation, and

helped propel SOURCECORP to one oftbe largest corporate fundraisers for Juvenile Diabetes in the DFW area. Prior to bis

position at SOURCECORP, Mr. Reinhold served as Division General Counsell Director ofIntemational Legal Affairs and

Assistant Secretary for AAF-McQuay, Inc. Mr. Reinbold has over 20 years oflegal experience, both in law firms and in-house

positions, with an emphasis in practicing in the areas of corporate and intemationallaw. Mr. Reinhold has a J.D. from S1.

Louis University, a B.S. in Marketing and Business Administration from the University of Illinois and has completed the

Advanced Management Program at The Wharton School, University of Pennsylvania. Mr. Reinhold was one of20 finalists in

the 2006 Dallas Business Journal's Best Corporate Counsel Awards, and in 2006, he was awarded a National Leadership

Award by the National Republican Congressional Committee. Mr. Reinhold has served on numerous civic organizations,

including the Board of Directors for the Louisville Ballet.

Arlin B. Goldberg has served as our ChiefInformation Officer since September 2008. Mr. Goldberg has over 30 years of

telecommunication industry experience. Previously, Mr. Goldberg served as the Executive Vice President of Infonnation

Technology for Eschelon Telecom from October 1996 until July 2007. Prior to that, Mr. Goldberg served as Director of

Information Services at Frontier Corporation, and also as Director of Infonnation Services for Enhanced TeleManagement,

Jnc, Early in bis career, Mr. Goldberg served in a variety of roles at Norstan Communications Systems, Inc. Mr. Goldberg

received his Bachelor of Science in Business degree in Accounting from the University of Minnesota Carlson School of

Management.

•

Robert E. Pickens has served as our Chief Marketing Officer since September 2008. Mr. Pickens has over 18 years of

senior level telecommunications experience. Before joining Securus Technologies, Mr. Pickens was Chief Operating Officer

of Esche Ion Telecom. During his eleven year tenure with that organization, he held leadership positions in marketing,

operations, and mergers & acquisitions integration management. Mr. Pickens has a Bachelor of Science in Business degree in

Marketing and Management from the University of Minnesota Carlson School Of Management.

Daniel A. Crawford has served as President of Syscon Justice Systems since July 2007. Prior to this position Mr.

Crawford held the role of Senior Vice President of Corporate Development for us from December 2006 to June 2007. In 2005,

Mr. Crawford held the role of Chairman, CEO and President of Tiburon, Inc. and has held such roles with a number ofleading

companies in the public safety and criminal justice industries. In 1992, Mr. Crawford founded EPIC Solutions, Inc., which was

named an INC 500 fastest growing company. Mr. Crawford has been named Business Leader of the Month by the National

Foundation for Enterprise Development, and One of the Most Influential Technology Leaders by the San Diego Business

Journal. Mr. Crawford began his professional career in the military as a Naval Aviator. After leaving active duty, Mr.

Crawford remained in the Naval Reserves and retired in 1996 with the rank of captain. Mr. Crawford received a Bachelors of

Sciencc degree in Business Administration from California State University, Northridge in 1970 and a Masters in Business

Administration from Chapman University in 1975. Mr. Crawford also holds a law degree from National University School of

Law, and has served on multiple boards of directors.

Joshua E. Conklin has served as our Vice President of Sales since December of2009. Mr. Conklin has the responsibility

for all new and existing facility sales for Securus Technologies, Inc. prior to joining Securus, Mr. Conklin was Senior Vice

President and General Manager of California and Nevada for Integra Telecom Inc. In this role, Mr. Conklin had full

operational responsibility for Integra Telecom of California and Nevada including sales, customer service, network operations,

new customer provisioning, and long haul network operations for the bulk ofIntegra's network in the western United States.

Prior to joining Integra, Mr. Conklin served with Eschelon Telecom Inc. as Senior Director of Network Sales for Colorado,

Minnesota, and Utah. In this capacity, Mr. Conklin was responsible for new acquisition sales in over 40% of Eschelon

Telecom's network footprint. Mr. Conklin also held several other sales roles within Eschelon including Sales Director, Sales

Manager, and Sales Training Manager over his 10-year career with Eschelon. Mr. Conklin holds a Bachelor of Business

Administration degree from West Texas A&M University.

•

Danny de Hoyos has served as Vice President of Customer Service since September 2008. Prior to joining Securus

Technologies, Mr. De Hoyos served as Director of Customer Operations for Medica lcx:ated in Minneapolis, Minnesota. From

2001 through the end of2007 Mr. de Hoyos was employed by Eschelon Telecom and served as Vice President of Customer

Service and Service Delivery. Prior to joining Eschelon, Mr. de Hoyos was Director of Support Services for One World Online

in Provo, Utah. Mr. de Hoyos has also held Customer Operations and Call Center Management leadership roles for other

technology companies such as Big Planet and Marketing Ally. Me. de Hoyos has a Bachelor of Science degree from Brigham

Young University.

70

file:/IZ:\RFP Technician Files\Financials\2009 Financials\2009 forml0~k.htm

3129/2010

�form 1O-k.htm

Page 88 of 112

•

•

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 formlO-k.htm

3/2912010

�Page 89 of 112

fonnlO-k.htm

•

Kathryn S. Lengyel has served as Vice President of Human Resources since June 2007. Prior to joining Securus in July,

2007, Ms. Lengyel held the position of Vice President of Human Resources at Excel Telecommunications from October 2005,

where she was an integral part ofthe company's acquisition ofVartec Telecom. Ms. Lengyel acted in a leadership capacity at

Stone Holdings, Inc. where she was the Director of Human Resources from November 1991 until 2005. She has created a

sucl;essful track record of employee initiatives, leadership and organizational change management. Ms. Lengyel has diverse

Human Resources experience in start-ups, growth and M&A situations. Ms. Lengyel holds both a Bachelor of Science degree

in Human Development and a Masters of Education degree in Human Resource Development from Vanderbilt University in

Nashville, Tennessee.

Larry V. Ehlers has served as the Vice President of Applications since January of 2009. Prior to joining Securus

Technologies he was Vice President of OSS & Applications at Eschelon Telecom in Minneapolis, Minnesota from 2005

thrOugh 2008 and served as Vice President of Corporate Systems at Advanced Telcom in Salem, Oregon from 2000 through

2005 prior to its acquisition by Eschelon. He was the Director oflnformation Technology and Operations at Quintessent

Communications and a consultant with Network Designs Corporation in Seattle, Washington. Prior to Network Designs Mr.

Ehlers served in a variety of Infonnation Technology roles within tile manufacturing industry. Mr. Ehlers received his

Bachelor of Science degree from Iowa State University and holds several technical certifications.

Patrick W Bro/sma has served as our Director of Enterprise Program Management Office and Corporate Development

since November of2008. Mr. Brolsma has over 15 years of senior level telecommunications experience. Prior to joining

Securus, Mr. Brolsma spent eight years with Eschelon Telecom where he held leadership positions in Operations, Marketing,

and Mergers & Acquisitions. Before Eschelon Mr. Brolsma held various management positions at US West (Qwest), Sprint

Communications and Unisys. Mr. Brolsma has a B.S. degree in Computer Science and Marketing from Minnesota State

University in Mankato, Minnesota.

•

AnthonyA. Tamer has served as a memberoftbe board of directors since February 2004. Mr. Tamer is a co-founding

Partner ofH.I.G. Capital, LLC and serves as a Managing Partner ofthe firm. Mr. Tamer has been an active investor in a

number of industries throughout H.I.O. 's life. Prior to founding H.I.O. in 1993, Mr. Tamer was a partner at Bain & Company,

one of the world's leading management consulting firms, and, through Bain Capital, one of the most successful private equity

funds in the United States. Mr. Tamer has ex.tensive opemting experience particularly in the communications and

semiconductor industries, having held marketing, engineering and manufacturing positions at Hewlett-Packard and Embarq

(fotmerly Sprint) Corporation. Mr. Tamer holds an M.RA. degree from Harvard Business School, and a Masters degree in

Electrical Engineering from Stanford University. His undergraduate degree is from Rutgers University. He currently serves on

the board of directors of several H.I.G. portfolio companies, none of which are registered filers.

Brian D. Schwartz has served as a member of the board of directors since February 2004 and served as President from

February until September 2004. Mr. Schwartz is a Managing Director ofH.l.O. Capital Management and HIO Ventures.

Since 1994, Mr. Schwartz has led numerous transactions in a diverse set of industries including business services (healthcare

and IT), building products, and manufacturing. Prior to joining H.I.O., Mr. Schwartz was a Business Manager in PepsiCo,

Inc.'s strategic planning group. Mr. Schwartz began his career with the investment banking firm of Dillon, Read and Co.

where he advised clients on transactions encompassing initial public offerings, debt offerings and mergers and acquisitions.

Mr. Schwartz earned his M.B.A. from Harvard Business School and his B.S. with honors from the University of

Pennsylvania. He currently serves on the board of directors of several H.I.G. portfolio companies, none of which are

registered filers.

Doug/as F. Berman bas served as a member ofthe Company's board of directors since February 2004. Mr. Bennan is a

Managing Director at H.I.C. Capital. He has made investments in the manufacturing, telecommunications, and business

services industries. Since Joining H.I.G. in 1996, Mr. Berman has led a number of industry consolidations, purchasing more

than 30 businesses creating several industry-leading companies. Prior to joining H.I.G., Mr. Berman was with Bain &

Company, where he managed a variety of projects for Fortune 100 clients, developing expertise in telecommunications,

financial services, and manufacturing. Mr. Berman earned a Bachelor of Arts degree, with Honors in Economics, from

University of Virginia and his M.B.A. from the Wharton School.

•

Lewis J. Schoen wetter has served as a member of the board of directors since February 2004 and served as Vice President,

until January 1, 2005. Mr. Schoenwetter is a Managing Director at H.I.G. Capital. With more than 10 years of experience in

private equity investing, Mr. Schoenwetter has played a significant role in more than 30 acquisitions with an aggregate value

in excess of $2 billion. Prior to joining H.I.G. in April 2003, Mr. Schoenwetter was a director with Levine Leichtman Capital

Partners. He currently serves on the board of directors of several H.I.G. portfolio companies, none of which are registered

filers.

71

file:I/Z:\RFP Technician Files\Financials\2009 Financials\2009 forml0-k.htm

3/2912010

�formlO-k.htm

Page 90 of 112

Sami W. Mnaymneh previously served as a member of the Company's board of directors from February 2004 to August

2007 and was re-appointed to the board of directors in July 2008. Mr. Mnaymneh is a co-founding partner and serves as a

Managing Partner ofH.I.G. Mr. Mnaymneh has been an active investor in a number of industries throughout H.I.G.'s life.

Prior to founding H.I.O. in 1993, Mr. Mnaymneh was a Managing Director at The Blackstone Group, where he specialized in

providing fmancial advisory services to Fortune 100 companies. Mr. Mnaymneh has led over 75 transactions with an

aggregate value in excess of$1O billion. Mr. Mnaymneh earned a B.A. degree from Columbia University and subsequently

received a lD. degree and an MBA degree, with honors, from Harvard Law School and Harvard Business School,

respectively. He currently serves on the board of directors of several H.I.O. portfolio companies, none of which are regislered

filers.

•

James Neal Thomas has served as a member of the board of directors since May 9, 2005. Mr. Thomas served on the board

of directors of Haggar Corp. and chaired its audit committee until November 2005. Until 2000, Mr. Thomas was a senior audit

partner ofEmst & Young, LLP, where he began his career in 1968. While at Ernst & Young, Mr. Thomas served mostly

Fortune 500 companies including Wal-Mart Stores, Inc., The Williams Companies, Inc. and Tyson Foods, Inc. Mr. Thomas is

a retired certified public accountant and holds a degree in accounting from the University of Arkansas.

Rob Wolfson has served as a member of the board of directors since April 2008. Mr. Wolfson has served as Managing

Director at H.I.G. Capital, a private equity investment firm that is an affiliate of the Company's majority stockholder, H.I.G. TNetix, Inc., since October 2008. Mr. Wolfson has more than 10 years of investment, financial services, and senior deal

leadership experience across many industries, most notably telecommunications, healthcare and business services. Prior to

joining H.I.G. Capital, he was Vice President of Business Development for IPWireless. a wireless infrastructure start-up

purchased by Nextwave Wireless. Mr. Wolfson began his career in mergers and acquisitions as a consultant with LEK

Consulting, a leading worldwide strategy consulting firm where he worked with Fortune 500 companies, private equity finns

and private equity portfolio companies. Mr. Wolfson earned his M.B.A. from Harvard Business School and his B.S. Cum

Laude with honors from Northwestern University.

Board Committees

Our board of directors directs the management of our business and affairs as provided by Delaware law and conducts its

business through meetings of the full board of directors and a standing meeting with our newly-appointed Audit Oversight

Director, who replaced the Audit Committee and operates in the same capacity. During 2009, the board of directors approved

the Audit Oversight Charter.

James Neal Thomas serves as the Company's Audit Oversight Director. Mr. Thomas qualifies as a financial expert, as

defined by SEC regulations, and is independent, as defined by the National Association of Securities Dealers Rule 4200. The

duties and responsibilities of the Audit Oversight Director include the appointment and tennination of the engagement of our

independent public accountants, otherwise overseeing the independent auditor relationship, reviewing our significant

accounting policies and internal controls and reporting his findings to the full board of directors.

•

In addition, from time to time committees may be established under the direction of the board of directors when necessary

to address specific issues.

Compensation Committee Interlocks and Insider Participation

Our board of directors has not established a compensation committee. Consequently, the entire board of directors

participates in the determination of our executive officers' compensation. No compensation meetings were held in 2009.

Indemnification Agreements

We have entered into indemnification agreements with certain of our officers and directors which provide for their

indemnification and the reimbursement and advancement to them of expenses, as applicable, in connection with actual or

threatened proceedings and claims arising out oftheir status as a director or officer.

Code of Ethics

We have adopted a written code of ethics that applies to our principal executive officer, principal financial officer, and

principal accounting officer or controller, or persons performing similar functions. Our code of ethics, which also applies to

our directors and all of our officers and employees, is filed as exhibit 14.1 to this report.

72

file:IIZ:\RFP Technician Files\Financials\2009 Financia1s\2009 formlO-k.htm

3/2912010

•

�Page 91 of 112

form lO-k.htm

•

ITEM 11. EXECUTIVE COMPENSATION

Compensation Committee Report

We, the members of the Board of Directors ofSecurus Technologies, Inc., have reviewed and discussed the Compensation

Discussion and Analysis with our Company's management. Based upon this review and discussion, the Board recommends

that the Compensation Discussion and Analysis be included in this Annual Report on Form lO-K.

BOARD OF DIRECTORS

Richard A. Smith

Anthony A. Tamer

Brian D. Schwartz

Douglas F. Berman

Lewis 1. Schoenwetter

Sami W. Mnaymneh

James Neal Thomas

Rob Wolfson

Compensation Discussion and Analysis

Introduction

We have a simple executive compensation program which is intended to provide appropriate compensation that is strongly

tied to our results. The program has only three major components: salary, annual bonus and a restricted stock purchase plan.

The program provides executives with a significant amount of variable compensation dependent on our performance. For

example, for our chief executive officer, more than half of his potential cash compensation is variable and a significant part of

his total potential compensation is via our restricted stock purchase plan.

•

The compensation program's overall objective is to enable us to obtain and retain (he services of highly-skilled

executives. The principles of our executive compensation program are reflected in its two variable compensation components:

annual honus and the restricted stock purchase plan. The program seeks to enhance our profitability and value by aligning

closely the financial interests of our executives with those of our stockholders. This alignment is created by strongly linking

compensation to the achievement of important financial goals. Our ability to reach the financial goals is dependent on strategic

activities. However, at the executive level, we measure success in these strategic activities principally by the effect on our

financial performance. The compensation program considers the cash flow, accounting and tax aspects to support the financial

efficiency of the programs.

The compensation program reflects that we operate with a small team of executives. The executives are each given

significant and extensive responsibilities that encompass both our strategic policy and direct day-to-day activities in sales and

marketing, finance, legal and regulatory, customer service, product development and other similar activities. The

compensation program conditions significant portions of management pay on the achievement of annual (for bonuses) and

long term (for restricted stock) financial performance goals.

The compensation packages for executives are designed to promote teamwork by generally using the same performance

goal for the annual bonus for all executives. The individual initiative and achievement of an executive is reflected in the level

of salary and bonus, which is determined annually by our board of directors. Of course, the primary evaluation of individual

perfonnance is made in the decision to retain the services ofthe executive. If an individual executive is not performing to

expe~tations, the executive is not retained.

Elements ofCompensation

OUf compensation program has only three principal elements: salary, annual bonus and a restricted stock purchase plan.

The remaining compensation paid through employee benefits and perquisites are not significant in amount or as a percentage

of any executive's compensation.

•

73

file:IIZ:\RFP Technician Files\Financia1s\2009 Financials\2009 form lO-k.htm

312912010

�form 10-k.htm

Page 92 of 112

Salary. We recognize that paying a reasonable cash salary is necessary to enable us to obtain and retain the services of

highly-skilled executives. We believe that a reasonable salary is a component of a well-rounded compensation program.

Annual Bonus. We believe that an annual cash bonus provides a means to measure and, if appropriate, reward elements

of corporate performance that are closely related to the efforts of executives. Under the Summary Compensation Table

following this section, the annual bonus is reported in the column labeled "Non-Equity Incentive Plan Compensation" rather

than in the "Bonus" column. This reporting reflects that the annual cash bonus has pre-established and generally nondiscretionary goals that determine whether any amount will be paid. Under the Summary Compensation Table, the "Bonus"

column is used for discretionary payments without pre-established goals. We refer to our annual cash incentive program as a

bonus program.

Because salaries alone would not be sufficient to reach a reasonable level of potential cash compensation to properly

compensate key executives, we believe it is appropriate and necessary to make bonus payments in cash on an annual basis

when earned. We choose to pay bonuses in cash rather than stock because we anticipate that executives would use this

payment to supplement their salaries. Also, if the annual bonus were paid in stock, the total compensation package might be

overweighted in stock. Consequently, executives might discount the future value of the benefit from the stock, which could put

us at a competitive disadvantage. The annual bonus as a percentage of an executive's total potential cash compensation

generally increases with the level and responsibilities of the executive.

Long-term Incentive- Restricted Stock Purchase Plan. We provide a long-teno incentive compensation program that is

based on our stock through the use of a restricted stock purchase plan. For stockholders, the long-term value of our stock is the

most important aspect of our performance. The price of our stock is the principal factor in stockholder value over time. The

value of a restricted share is tied directly and primarily to the ultimate fair value of our stock. Restricted stock is a means of

aligning financial interests of executives and stockholders.

We believe that stock-based incentives through the restricted stock purchase plan ensure that our top officers have a

continuing stake in our long term success. We maintain the 2004 Restricted Stock Purchase Plan to provide executives with

opportunities to acquire our Class B Common Stock, and our policy is to allow only executive officers and key employees to

participate.

Employee Benefits. Our executives participate in all of the same employee benefit programs as other employees and on

the same basis. These programs are a tax-qualified retirement plan, health and dental insurance, life insurance and disability

insurance. Our only active retirement plan for U.s. employees is a 40 1(k) plan in which executives participate on the same

basis as other employees. Additionally, we make a matching contribution to the 401(k) plan. The amount of the matching

contribution depends on the percentage of their own compensation, up to IRS limits, that each executive chooses to defer in

the 401(k) plan. In 2009, the amount of our matching contributions for the named executive officers ranged from $7,769 to

$8,250 as shown in the "All Other Compensation" column on the Summary Compensation Table following this section.

•

Perquisites. We provide perquisites only for our chief executive officer, Mr. Smith, which consists ofa bi-annual

reimbur&e of up to 5\0,000 related to direct medical costs and up to $150 per month for borne and wireless internet cbarges.

Key Factors in Determining Compensation

Performance Measures. The annual bonus has been measured prinCipally on our earnings before interest, income taxes,

depreciation and amortization ("EBITDA"). All of our executives have the same EBITDA target for their annual bonus.

EBITDA is used because we believe that it repre&ents the best measurement of our operating earnings. The annual bonus is

intended to be paid primarily based on actions taken and decisions made during that fiscal year. Interest, income taxes,

depreciation and amortization are excluded because those items can significantly reflect our long-teno decisions on capital

structure and investments rather than annual decisions. We believe it is appropriate to determine bonuses based on our •

EBITDA, which measures our performance as an entity, particularly considering there is no public market for our stock.

Because EBITDA for performance purposes is intended to reflect operating earnings, our board of directors may make

adjustments in the calculation ofEBITDA to reflect extraordinary events.

74

•

file:IIZ;\RFP Technician Files\Financials\2009 Financials\2009 fonn 1O-khtm

3/29/2010

�Page 93 of 112

form 1O-k.htm

•

Th~ bonus based on EBITDA is measured on an annual basis. The use of annual targets fits with our annual business plan

and aIIows us to measure the executive group's performance against targets which we believe can be set in a reasonable

manner,

Th!e estimated fair value of our stock is used for all long-term incentive purposes through the restricted stock purchase

plan. We often estimate the value of our restricted stock by obtaining a valuation by an accredited firm.

We have not had the need to establish a policy for the adjustment or recovery of awards or payments when the relevant

perfonnance measures are restated or adjusted in a way that would reduce the size of the award or payment. The board of

directors has the discretion to waive or reduce a performance goal but this authority has been used infrequently.

Individual Executive Officers. For compensation setting purposes, each named executive officer is considered

individually, however, the same considerations apply to all executives. In setting salary, the primary factors are the scope of

the officer's duties and responsibilities, the officer's performance of those duties and responsibilities, the officer's tenure with

us, and a general evaluation of the competitive mll!ket conditions for executives with the officer's experience.

Fot the named executive officers and other executives, annual bonus potential is set as a percentage of salary. The

percentage of salary amounts used for this purpose reflects the officer's duties and responsibilities. The same measurement,

EBITDA, is used for all officers and executives to encourage them to focus on the same company goals. In setting the salary

and bonus potential, we look at total potential cash compensation for reasonableness and for internal pay equity.

W~ have not looked specifically at amounts realizable from prior year's compensation in setting compensation for the

current year. We believe that the amount of compensation for each year should be reasonable for that year.

Determining the Amount 0/Each Type o/Compensation

•

Roles in Sening Compensation. Mr. Smith, as Chairman, President and Chief Executive Officer, makes recommendations

to the Board of Directors with respect to compensation of executives (including the named executive officers) other than

himself for each of the Company's compensation elements. The Board of Directors reviews, and in some cases revises, the

salary and bonus potential recommendations for these executives. The Board of Directors makes the determination about all

restricted stock issuances.

The Board of DirectoTS makes an independent determination with respect to the compensation for Mr. Smith as Chairman,

President and Chief Executive Officer. This determination involves all elements of his compensation. Mr. Smith's

employment agreement establishes the minimum salary and bonus potential.

Timing o/Compensalion Decisions. Compensation decisions, including decisions on restricted stock issuances, are

generally made periodically by the Board of Directors, typically in March of each year.

Salary. We intend for the salary levels of our executives to be in the competitive market range but do not engage in a

formal market analysis. Executives are generally considered for salary adjustments annually.

Bonus. Cash bonus opportunities are established annually in accordance with our incentive plan. The amount of annual

bonuses earned or unearned is not a major factor in base salary decisions.

Restricted Stock. The restricted stock purchase plan is designed primarily to provide incentives to those executives who

have the most potential to impact stockholder value. The restricted stock purchase plan gives consideration to reasonable

compensation levels. Generally, the restricted stock is set initially and then periodically reviewed by the Board of Directors.

Other Compensation. Other types of compensation, including employee benefits and perquisites, do not impact other

compensation decisions in any material way. The employee benefits are changed for executives at the same time and in the

same Illanner as for all other employees.

•

Bfllancing Types o/Compensation. As noted above, we do not maintain any supplemental retirement plans for executives

or other programs that reward tenure with us more than our actual performance. Our restricted stock grants are our method of

providing a substantial part of an executive's retirement and wealth creation. In contrast, we expect that most executives will

use their salary and annual cash bonus primarily for current or short-term expenses. Since the restricted stock plan is our

primary contribution to an executive's long-term wealth creation, we determine the size ofthe restricted stock purchase plan

with that consideration in mind. We intend that our executives will share in the creation of value in the Company but will not

have substantial guaranteed benefits upon their termination if value has not been created for our stockholders.

75

file:IIZ:\RFP· Technician Files\Financials\2009 Financials\2009 form IO-k.htm

3129/2010

�fonn 1O-k.htm

Page 94 of 112

•

•

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 fonnlO-k.htm

3129/2010

�Page 95 of 112

formlO-k.htm

•

Other Matters Related to Compensation

Tax and Accounting Considerations. We are covered by Internal Revenue Code section I 62(m) that may limit the

income tax deductibility to us of certain fonns of compensation paid to our named executive officers in excess of $1,000,000

per year. If these limits should become of broader applicability to us, we will consider modifications to our compensation

practices, to the extellt practicable, to provide appropriate deductibility for compensation payments.

We record the grant date fair value of all stock issued to employees as an expense over the related vesting period. We

apply the standards required for share based payments in the accounting for issuances of stock under our 2004 Restricted Stock

Purchase Plan.

Change of Control Triggers. We provide a change in control benefit under the 2004 Restricted Stock Purchase Plan,

which provides for immediate vesting upon a change in control. Additionally, our employment agreements with Mr. Smith and

Mr. Markert and severance agreements with the other named executives, which were effective in January 2010, provide that

they will receive certain compensation if they are terminated without cause. (See "Employment Agreements" for a description

of compensation and benefits provided to named executives upon termination without cause, including a change in

control.) We believe this benefit will help protect stockholders' interests during any negotiations relating to a possible

business combination transaction by encouraging our top executives to remain with us through a business combination

transaction.

No Stock Ownership Guidelines. We have not adopted any stock ownership requirements or guidelines, but each holder.

of our restricted stock is subject to the terms of his or her respective stock purchase agreements, the 2004 Restricted Stock

Purchase Plan and a stockholders' agreement. We have not adopted any policies about hedging the economic risk of our stock.

We believe that no executives have engaged in hedging or similar activities with our stock.

•

Compensillion In/ormation. We have engaged a consultant to conduct a benchmarking study of compensation pricing for

all employees, including the named executives. Salary market data was assimilated from various sources for the

telecommunication and software industries to ensure compensation ranges were in line with external market pricing. The study

was completed in June 2009.

Management of Compensation Risk. Our board of directors has discussed the impact our compensation policies and

practices for all of our employees may have on our management of risk and has concluded that our programs do not encourage

excessive risk taking. The board considered that the policies have been designed and consistently and effectively applied over

a substantial period oftime. There is a balance of fixed and variable compensation with both cash and equity components, and

employees are required to adhere to the Code of Business Conduct and Ethics.

Fiscal 2009 Compensation

For the 2009 fiscal year, the compensation of executives was set and administered consistent with the philosophy and

polices described above. Because we met our performance objectives for 2009, we awarded annual bonuses to our named

executive officers. The salaries and bonuses for the named executive officers are shown on the Summary Compensation Table

following this section.

For the named executive officers during the 2009 fiscal year, the potential bonus as a percentage of base salary ranged

from 50% to III %. The 2009 annual expense for restricted stock is shown in the "Stock Awards" column on the Summary

Compensation Table following this section. There were no restricted stock sales to named executives in 2009.

76

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 fonnlO-k.htm

3/29/2010

�fonn lO-k.htm

Page 96 of 112

•

The following table sets forth the summary compensation for each of our named executive officers for the years ended

December 31> 2007> 2008 and 2009:

Summary Compensation Table

Name and

Principal

Position

Year

Bonus

All Other

Compensation

p~

Salary

Non-Equity

Incentive Plan

Compensation

Stock

Awards

p~

!4}

Richard A. Smith - Principal

Executive Officer, Chairman,

Chief Executive Officer and

President

William D. Markert - Principal

Financial Officer, Chief

Financial Officer

Dennis J. Reinhold - Vice

President, General Counsel and

Secretary

Daniel A. Crawford President, Syscon Justice

Systems

Robert E. Pickens - Chief

Marketing Officer

(1)

(2)

(3)

(4)

(5)

2009

$

465,231 $

$

2008

$

216,346 $

2009

$

2008

S

2009

2008

2007

2009

2008

2007

2009

2008

$

$

$

$

$

$

$

$

Total

S 939,718

$

464,995

$

9,38:5

$

54(3) $

204,948

$

134,853

$,

556,206

223,269 $

$

19

$

99,975

S

76,437

$

399,700

99,231 S

$

223:269

215.000

203.616

269.462

224,923

\08 1327

223 1269

45 1481

107

10(3) $

$

$

$

11°00

$ \OOIOoo!S~ $

$

$

S

$

$

$

S

$

$

$

1,207

44,064

39,437

$

182,742

$

$

$

$

$

$

$

$

7,769

6 1480

7,750

8,250

6,748

3,388

51,708

6 1783

$

$

128,661

96,940

4 z082Pl $

5,569

$

18

$

12Pl $

$

3

10

$

3

$

$,

99.975

88.128

$

332,220

314,690

316,935

406,391

328,623

HI,7\8

3741962

74,299

991975

22,032

$

$

S

$

$

$

Includes the discretionary matching contributions by the Company for our 401(k) savings plan, reimbursed relocation e){penses and relocation bonuses

of$55,719 to Mr. Marken and $40,000 to Mr. Pickens in 2009, and $100,000 to Mr. Smith and $19,281 10 Mr. Markert in 2008.

Includes bonuses paid in 2010 for attainment ofEBITDA objectives in 2009.

In 2008, Mr. Smith, Mr. Markert, Mr. Reinhold, Mr. Pickens and Mr. Crawford wcroawarded 57,013 shares, 11,415 shares, 10,273 shares, 5,707 shares

and 5,707 shares, respectively.

2009 salaries included 27 bi·weekly pay periods compared tn 26 in 2008.

Bonus paid in July 2007 related to the consummation of the Syscon acquisition in June 2007.

The following table represents outstanding equity awards, or restricted stock grants that were unvested as of December 31,

2009:

Name

Richard A. Smith

William D. Markert

Dennis 1. Reinhold

Daniel A. Crawford

Robert E. Pickens

Totals

(1)

(2)

•

Outstanding Equity Awards at December 31, 2009

Equity Incentive

Market or

Plan

Payout

Awards: Number

Number of

Market Value

of

Value of

Shares That

Unearned

or Shares That Unearned Shares

Shares That

Have Not

That Have Not

Have

Have Not

Vested (1)(a)

Vested(2)

Vested(1)(b)

Not Vested(2)

17,835

2,378

2,226

1,237

11287

24,963

178

24

22

12

13

$

249

23,186

6,182

5,652

232

62

57

3,141

31

3,189

32

41,350 =$====4 14

......

All shares were purchased by the executives for $.01 per share. Restricted stock vests (a) ratably over a period or periods, or (b) based upnn either a

change in control of the Company or pcrfonnanee criteria as provided in the related restricted stock purchase agreement.

Assumes a market value ofS.OI per share, which we estimated to be the fair value of the stock as of the last grant date.

77

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 formlO-k.htm

3/29/2010

�Page 97 of 112

fonnIO-k.htm

•

The following table details the Class B restricted stock shares and the fair value of stock-based compensation to our

directors and named executive officers for the year ended December 3), 2009:

Number of

Name

Richard A. Smith

William D. Markert

Dennis 1. Reinhold

Daniel A. Crawford

Robert E. Pickens

James Neal Thomas

Totals

Value Realized

Shares Vested

On Vesting(l)

16,052 $

161

2,854

29

2,401

24

1,334

13

1,231

12

4,183

42

28,055 ;;;,$====2;,;8=1

(J)Thc fairvaluc is representative of the most reeent fair value orS.OI per share limes the

number of shares vested during 2009. None of the directors or named executive officers

received eash or other property as their restricted shares vested. Because of the transfer

restrictions on our Class B Common Stock, the holders nf such shares cannot freely transfer

them.

Employment Agreements

•

On June 11, 2008, we entered into an employment agreement with Richard A. Smith to appoint him as our President and

Chief Executive Officer. The employment contract extends through July 1,2012 and provides that Mr. Smith will receive (i) a

minimlUn base salary of $450,000 per year; (ii) the potential to earn an annual bonus of $500,000, which is earned upon

achievement of objectives mutually agreed upon by Mr. Smith and our board of directors each year; (iii) eligibility to receive

restricted stock shares of the Company's Class B common stock; and (IV) other benefits, such as life and health insurance, paid

vacation, and reimbursement of business expenses. Additionally, in 2008 Mr. Smith received a one-time bonus of $ 100,000 in

conjunction with the sale of his primary residence and reimbursement of his moving expenses. Mr. Smith will also receive a

$200,000 bonus payable at the end of the contract term .

Mr. Smith reports directly to the board of directors and must secure the board's written consent before consulting with any

other entity or gaining more than a 5% ownership interest in any enterprise other than ours, Wlless such ownership interest will

not have a material adverse effect upon his ability to perform his duties under this agreement. We may terminate Mr. Smith's

employment for cause, in which case we will pay him any base salary accrued or owing to him through the date of tennination,

less any amounts he owes to us. We may also terminate Mr. Smith's employment without cause or Mr. Smith may tenninate

his own employment due to the occurrence of events constituting constructive discharge. If Mr. Smith is terminated without

cause Or is constructively discharged, including upon a change of control, we will pay Mr. Smith an amount equal to (i) the

lesser <If (I) two times his annual base salary or (2) the amount of remaining base salary that would have been payable to him

from the date of such tennination of employment through the agreement expiry date provided that amount is not less than Mr.

Smith's base annual salary, plus (ii) the benefits which were paid to him in the year prior to the year in which his employment

was terminated, plus (iii) a pro-rated bonus for the year in which Mr. Smith's employment was terminated.

During Mr. Smith's employment and for the two-year period immediately following the expiration or earlier termination

of the employment period, Mr. Smith is prohibited from competing with us anywhere in the United States, including locations

in which we currently operate and plan to expand, and must abide by customary covenants to safeguard our confidential

information.

78

•

file:/IZ:\RFP Technician Files\Financials\2009 Financials\2009 fonnlO-k.htm

3/2912010

�fonn IO-k.htm

Page 98 of 112

In 2008, we entered into an employment agreement with William D. Markert to appoint him as our Chief Financial

Officer. The employment contract extends through July 1,2012 and provides that Mr. Markert will receive (i) a minimum

base salary of$215,000 per year; (ii) the potential to earn an incentive bonus of$107,000, which is earned upon achievement

of objectives determined by our board of directors each year; (iii) eligibility to receive restricted stock shares of the

Company's Class B common stock; and (iv) other benefits, such as life and health insurance, paid vacation, and

reimbursement of business expenses. Additionally, Mr. Markert received a one-time bonus ofS75,000 in conjunction with the

sale of his primary residence and reimbursement of his moving expenses.IfMr. Markert is terminated without cause,

including upon a change in control, he will be entitled to receive up to twelve months of compensation and benefits from the

effective date of his termination.

In January of 20 lOwe entered into severance agreements with other named executives, which provide for continued

payment of their base salaries and heath care benefits for a period of one year from their termination date should they be

terminated without cause, including a change in control.

2004 Restricted Stock Purchase Plan

We have a 2004 Restricted Stock Purchase Plan under which our employees may purchase shares of our Class B common

stock. In August 2008, we authorized an additional 65,000 shares of Class B Common Stock. In September, 2008, we filed a

Third Amended and Restated Certificate ofIncorporation which authorized 165,000 shares of Class B common stock for

issuance. Our board of directors administers the restricted stock purchase plan.

On March 25,2009, we filed a Fourth Amended and Restated Certificate ofIncorporation, which authorized 175,000

shares of Class B Common Stock for issuance. All issued shares of Common Stock are entitled to vote on a one share/one vote

basis. The Restricted Stock Purchase Plan is designed to serve as an incentive to attract and retain qualified and competent

employees. The per share purchase price for each share of restricted stock is determined by our board of directors. Generally,

restricted stock will vest based on performance criteria, ratably over a period or periods, or upon a change of control of the

Company, as provided in the related restricted stock purchase agreements and the plan.

Director Compensation

Except for Messrs. McCarthy and Thomas, our directors receive no compensation for serving on the board; however, they

receive reimbursement of reasonable expenses incurred in attending meetings. In June 2009, Mr. McCarthy resigned from the

Audit Committee and board of directors of the Company. Mr. McCarthy received $48,750 for serving on the board and Audit

Committee in 2009. Mr. Thomas receives $74,000 annually for serving on the board and as the Audit Oversight Director.

Additionally, Mr. Thomas and Mr. McCarthy each purchased 1.335 shares of restricted stock for $10.00 per share and 4,561

shares of restricted stock for $.01 per share in 2006 and 2008. No shares were purchased during 2007 and 2009. OUf outside

director compensation for the year ended December 31, 2009 is as follows:

•

Director Compensation Table(l)

Fees Earned

Total

or Paid

Stock

Name

In Cash

Awards

Compensation

8 $ I

74,008

James Neal Thomas

$

74,000 $

8 $

48,758

$

48,750 $

Jack McCarthy

(1) Our only equity compensation plan is our 2004 restricted stock plan which has lx:cn

approved by shareholders. As of December 31, 2009, there were 175,000 shares authorized

under the plan.

79

•

file:I/Z:\RFP Technician Files\Financials\2009 Financials\2009 formlO-k.htm

3/29/2010

�Page 99 of 112

form 1O-k.htm

•

ITEM 11. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

The following sets forth certain infonnation, as of March 1,2010, with respect to the beneficial ownership of shares of our

common stock by;

•

each person who is known to us to beneficially own more than 5% of the outstanding shares of common stock;

•

each of our directors;

•