This text is machine-read, and may contain errors. Check the original document to verify accuracy.

•

sheet distributed to Securus Team

: continuous NOC

doc:umentation

1.3.1.9.2.2.9.2.2

1.3.1.9.2.2.9.2.3

... -_...-.--_.

Center

-----.---..,.=:::.:..:.:::----,.--~-----I

•

documentation

1.1.2

Transition

cables from Incumbent tD Securus SCP

distributed to Securus Team

: continuous NOC

•

�•

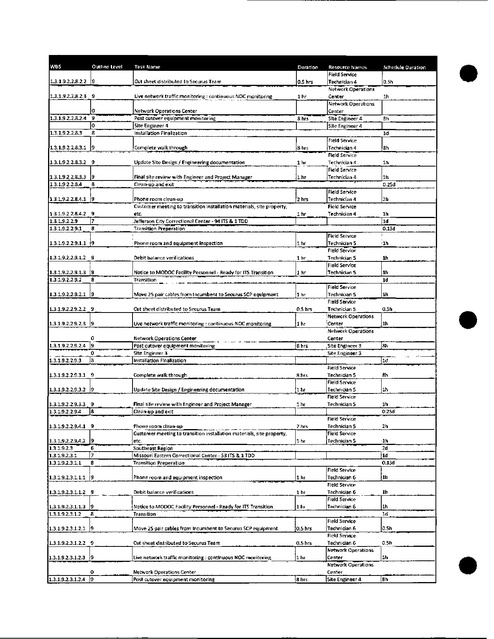

Outline level'

WBS

0

[8

1.3.1.9.2.3.1.3

1.3.1.9.2.3.1.3.1

9

1.3.1.9.2.3.1.3.3 9

1.3.1.9.2.3.1.4

j8

~

9

-.,

-

..

~erifications

1.3.1.9.2.3.2.2.3

Uve networt< traffic monitoring : contin~ous NOC monitoring

Network Operations Center

Post cutover ~quipment monitoring

ISite Engineer4

Installation Finalization

•

10

1.3.1.9.2.3.2.3

8

1.3.1.9.2.3.2.3.2

Update Site Design f Engineering documentation

~th

J

9

8

IFinal site review

aean-up and exit

1.3.1.9.2.3.2.4.1 19

1 hr

1 hr

-

I

8hrs

2hrs

Engineer and Project Manager

-

-_. --

Ilhr

9

...1Notice to MODOC Facility

Transition

1.3.1.9.2.3.3.2.1 .19

perso~nel-

Ready for ITS Transition

I Move 25 pair cables from Intumbent to SecuruS SCI' equipment

.

"

0

1.3.1.9.2.3.3.2.4 19

0

1.3.1..9.2.3.3.3

..

j8

1.3.1.9.2.3.3.3.1

9

1.3.1:~.2.:3.~:3.219

1.3.1.9.2.3.3.3.3

9

1 hr

I

."- _.

...._-

I:ield Service

Technician 7

Field Service'

Technician 7

Ilhr

Ilhr

...

_0'

Network Operations Center

I Post cutover equipment monitoring

Site Engineer 4

Ilnstallation Finalization

...

18 hrs

.

~--

Complete walk through

_I Update Site Design I Engineering documentation

I

B hrs

..

Final site revIew with Engineer and Project Manager

..

Ilhr

1 hr

I

Sh

1

116h

11h

". ._. 0.38d

-.--

IField Service

Technician 8

Field Service

Technician 8

Network Operations

Center

Network Operations

Center

ISite Engineer4

Site Engineer 4

1

1h

2h

I.Field Service

Technician 8

IUve network traffic monitoring: continuous NOC monitoring

_.

'. ..

Technician 7

[

10.5h

2d

." Field Service

Ilhr

0.5 hrs

...

-

I:ield Service

Technician 8

Field Service

Technician 8

Cut sheet distributed to Securus Team

9

1.3.1.9.2.3.3.2.3 19

'v

Debit balance verifications

1.3.1.9.2.3.3.1.319

1.3.1.9.2.3.3.2

8

1.3.1.9.2.3.3.2.2

_

1h

l~etwDrk Operations

Center

5ite Engineer'4

ISite Engineer 4

Ihr

~

1h

I.Field Service

Technician 7

"

2h

11h

IField Service

Technician 7

NetwDrk Operations

Center

I:ield Service

Technician 7

Ilhr

IPhone room and eqUipment inspection

-

-

lId

".

116 hrs

..

...

- ..

Field Servia!

Technician 7

1.3.1.9.2.3.3.1.1 19

1.3.1.9.2.3.3.1.2

11h

2d

IO.2Sd

[

1.3.1.9.2.3.2.4.2

1.3.1.9.2.3.3

17

1.3.1.9.2.3.3.1

8

•

..

13hr.

9

2h

Field Ser~ice

Technician 7

I

IPhone room dean-up

Customer meeting to transition installation materials, site property,

etc.

[South Central Correctional Center -79 ITS & 1 TOO

Transition Prep'eration

. "--

.-

Field Service

Technician 6

lField Service

Technician 6

field Sen-ice

Technician 7

Field Service

Technitian 7

..

1h

jO.25d

[

I

IcomPlete walk through

1.3.1.9.2.3.2.3.3

1.3.1.9.2.3.2.4

--

I

1 hr

-_ ..

1.3.1.9.2.3.2.3.1 19

9

.

lo.shrs

-.

..

J

9

11 hr

~-

ICut sheet distributed to Securus Team

10

2 hrs

11 Ilr

"

1.3.1.9.2.3.2.2.2 19

1.3.1.9.2.3.2.2.4

Ilh

.'

Move 2S pair cables from Incumbent to Securus SCP eqUipment

9

Sh

I

21lrs

"~-

,--_.

[ld

IField Service

Technician 6

Field Service

Technician 6

I

Notice to MODOC Facility Personnel· Ready for ITS Transition

..lTransition

...

- ...

.

9

L

Field Service

Tethnician 6

1 hr

.-

I Debit balance

1.3.1.9.2.3.2.1.3 9

1.3.1.9.2.3.2.2 J8

....

1.3.1.9.2.3.2.2.1

Final site review with Engineer and Project Manager

jClea<l-up and e~it

Phone room and equipment inspection

1.3.1.9.2.3.2.1.2 19

.,y--

Ilhr

-

.-

Scheduloe Duration

Resource Names

Site Engineer 4

Shrs

Phone room clean-up

I~ustomer meeting to transition installation materials. site property,

etc.

EaStern Reception & Diagnostic Center- 167 ITS & 1 TOO

.. ,,)Transition Preperation

-- -- .. _-

1.3.1.9.2.3.1.4.2 19

1.3.1.9.2.3.2

7

1.3.1.9.2.3.2.1 18

9

1

..

IUpdate Site Design f Engineering documentation

.-

1.3.1.9.2.3.2.1.1

DuratIon

Complete walk through

1.3.1.9.2.3.B.2 19

1.3.1.9.2.3.1.4.1

Task Name

Site Engineer 4

[Installation Finalization

13h

._.-

1h

[Id

O.13d

11h

.

.

...

Ih

11h

1d

11h

O.Sh

11h

ISh

I

-

--,-

-..

lId

FIeld Seiiiice

Technidan 8

..-

8h

IField Service

Technician 8

Field SeNite

Technician 8

11h

".

1h

�-_

13192334

Outline Level

8

1.3.1.9.2.3.3.4.1

9

WBS

..

...

1.3.1.9.2.3.3.4:2..19

7

1.3.1.9.2.3.4

1.3.1.9.2.3.4.1 ~8

1.3.1.9.2.3.4.1.1

-_. -

Task Name

-

IDebit balance verifications

.. -

1.3.1.9.2.3.4.1.3 9

1.3.1.9.2.3.4.2

18

1.3.1.9.2.3.4.3

Field Service

Technician 9

Ifield Service'

Technician 9

Field Service

Technician 9

_.

I

0.5 hrs

distrib~.ted ~o Sewrus Team

_.

INetwork Operalions Center

Post cutover equipment monitoring

ISite Engineer 1

Installation Finalization'

Ihr

1

8 hrs

o'

I

_.

lcomPlete .walkthrough

-

.

Ih

lId

O.Sh

..

14 hr.

- --

10.5h

..

1h

I

- .-

8h

I

O.5e!

Technician 9

- --- Field Service

Ihr

IFinal site review with-Engineer and Project Manager

Clean.up and exit

.

1.3.1.9.2.3.4.3.3 19

8

1.3.1.9.2.3.4.4

11 hr

14h

ITechnician 9 ...

~ield Service

Technician 9

. -.-

Ih

11h

O.25d

_ r ___ '

-_

..

I Phone room clean·up

._.12 hrs

Customer meeting to transition installation materials, site property,

etc.

1 hr

IFarmington Correctional Center· 135 ITS & 1 TOO

I

- .'Transition Preperation

"

1.3.1.9.2.3.4.4.2 9

1.3.1.9.2.3.5

.17

8

1.3.1.9.2.3.5.1

.-.

1.3.1.9.2.3.5.1.1 19

1.3.1.9.2.3.5.1.2

9

.-

1.3.1.9.2.3.5.1.3 19

1.3.1.9.2.3.5.2

8

.

INotice to MODOC fadflty Personnel· Ready for lTS Transition

Transition

-

.- .

IMove 25 pair cables from Incumbent to Securus SCP equipment

. ...

-

1.3.1.9.2.3.5.2.1 19

CUt sheet distributed to Securus Team

1.3.1.9.2.3.5.2.2 9

':.3.1.9.2.3.5.2.3 19

IUve network traffic monitorins : ~:ntinuous NOC monitoring

---

0

1.3.1.9.2.3.5.2.4 19

.- 0

Ig

1.3.1.9.2.3.5.3

Network Operations Center

IPost cutover equipment monitOring

Site Engineer 4

IInstallation Finalization

..

1.3.1.9.2.3.5.3.1

1.3.1.9.2_3.5.3.2

r._~

Compiete walk through

9

19

1.3.1.9.2.3.5.3.3 9

1.3.1.9.2.3.5.4

18

1.3.1.9.2.3.5.4.1

..

9

1.3.1.9.2.3.5.4.2 19

1.3.1.9.2.3.6

7

1.3.1.9.2.3.6.1

18

IUpdate Site Design I Engineering documentation

-- ."

-

..

11 hr

I~ield Service

Technician 1

lal

0.511r5

lar

18 hrs

I

..

-

Final site review with Engineer and Project Manager

IClean-up and exit

Phone room clean·up

1~lIstomer meeting to transition installation materials. site property,

etc.

...

Southeast Correctional Center ·88 ITS & 1 TOO

jTransition Preperation

1h

12d

0.25d

I~ie1d Service

Technician 1

Field Service

Technician 1

12 hrs

.rr",

Debit balance verifications

. .J2h

I

1 hr

Iphone room and equipment inspection

-.

Technician 9

Field SerVice

Technician 9

--

16hrs

12hrs ... -

I.field Service

Technician 1

Field Service

Technician 1

"r

•

J~eld Service

1.3.1.9.2.3.4.4.1 19

.

I~ield Service

Update Site Design I Engineering documentation

-

--

I~ield Service

Technician 9

Network Operations

Center

1~etwork Operations

Center

Site Engineer 1

ISite Engineer 1

10.5 hrs

.

Uve network traffic monitoring: continuous NOC monitoring

10

9

10

8

11h

Field Service

Technician 9

Icut sheet

..

Ih

I

1 hr

•

."

11h

- . ...

Id

IO.13d

I

. Move 25 p,ir cables from Incumbent to Securll. SCP equipment

9

9

I

Ilhr

.

.-

.------

9

1.3.1.9.2.3.4.3.11

1.3.1.9.2.3.4.3.2

."

1 hr

-- -'

-..

2h

Ifield Service

Technician 8

Notice to MODOC Facility Personnel· Ready for ITS Transition

ITransition

..

1.3.1.9.2.3.4.2.2 .19

1.3.1.9.2.3.4.2.4

Field Service

Technician 8

11 hr

Phone room and equipment inspection

"."."

1.3.1.9.2.3.4.2.3

.--

.

9

2 hr.

Schedule Our.toon

025d

Resource Names

-

Phone room clean-up

1~lIstomer meeting to transition installation materials, site property,

etc.

--- .

Ozark Correttional Center· 26 ITS & lIDO

jTransition Preperation

1.3.1.9.2.3.4.1.2 19

1.3.1.9.2.3.4.2.1

DuratIOn

Clean up a d extt

12h

--

~~

Ih

11h

ld

_

.

11h

...

a.SIt

I

~etwork Operations

Center

Network OperatiDlis

Center

ISite Engineer 4

Site En!!in';;'r 4

11h

I~h

Ild

I

Field Service

Technician 1

.

-~.

~

.

16h

I.Field Service

"Technician 1

Field Service

Technician 1

12h

I

I

Ih

IO.38d

3 hr$

Field Service

Technician 1

- ----

3h

1 hr

11 hr

I:ield Service

Technician 1

_

I

I

""

r

11h

1d

IO.13d

--

•

�•

ICut sheet distributed to Securus Team

... ._.

-

I

Network Operations Center

Post tutover equipment monitoring

[Site Engineer 4

Installation Finalization

..

10

B

._...

1.3.1.9.2.3.6.3.1 19

- --

1.3.1.9.2.3.6.4.2 9

1.4

12

•

1.4.1.16

1.4.1.16.1

1.4.1.16.2

1.4.1.16.3

. -... -

14

- ..4

15

5

..

Is

-.

4

--

.. 14

4

14

4

[4

4

15

5

15

5

14

5

Is

5

Is

5

..

IS

4

15

5

15

•

[

[Site Engi~:er 4

I

Ihr

I:ield Service

Technician 2

Field Sel\lice

Technician 2

11 hr

I:ield Service

Technician 2

.. -

..

e~it

IReview Guarded Exchange interface status

. ReView Guarded Exchange Monitoring program status

JGreen Llght for ITS Transition

Securus & Missouri DOC Project Team Meeting - Touch Point:

Transition Progress Review - Northwest Region

_LReview current progress on ITS transition

.

Review issues register

IReview risk register

_.

r

~

12 hr.

1 hr

I

..

.

Sh

12 hrs

2 hrs

12 hr.

2hrs

12 hrs

2 hrs

~

I

...

11 hr

2 hrs

12 hrs

2 hrs

12 hrs

2hrs

[2 hrs

Ih

11h

0.25d

I.Field Service

Technieian 2

Field SerVice

TechniCian 2

12h

0.2Sd

12h

2h

12h

2h

12h

2h

IProject Manager

Project Manager

IProject Manager

Project Manager

IProject Manager

Project Manager -

I

.•. Project Manager

- ...

10.5 hrs

0.5 his

10.5 hrs

0.5 hrs

I

0.5 hrs

10.5 hrs

0.5 hrs

10.5 hr.

O.S hrs

10.5 hrs

10.5 hrs

0.5 hrs

10.5 hrs

Project

IProject

Project

IProject

Project

Manager

Manager

Manager""

Manager

Manager

IProject Ma.nag-:r

Project Manager

IProject Manager

Project Manager

I

Project Manager

I Project Manager ..

...

IProject Manager

JProject Manager

Project Manager

IProject Manager

11h

--2h

12h

2h

12h

2h

12h

.

0.06d

10.Sh

O.Sh

10.5h

O.Sh

IProject Manager

I

.

10.13d

.O.Sh

- .. 10.Sh

0.5h·

Project Manager

IProject Manager

Project Manager

.

-

Ih

.12.5d

I

0.5 h ..

10.5 hrs

0.5 hrs

..

ISh .

I

..-

.

Ih

.I

.Is hrs

Distribute Information / Stakeholder Updates I Report Performance

IWeekly Project Stakeholder Meeting

..

Weeklv Project Stakeholder Meeting

IWeekiv Project Stakeholder Meeting

'. -Weekly Project Stakeholder Meeting

IWeekly Project Stakeholder Meeting

..

Weekly Project Stakeholder Meeting

I~ecuru. & Missouri DOC Project Team Meeting· Touch Point: PreTransition Installation Review

Review current progress

IConfirm LEC Tllnstallations complete

Confirm hardware Shipment. received at each' facility

l~evil!W and confirm Securus Installation Team schedules and fadlity

access

_.

Weekly Project Stakeholder Meeting

IWeekly Project Stakeholder Meeting

..

..

Weekly Project Stakeholder MIl!eting

IWeekly Project Stakeholder Meeting

Weekly Project Stakeholder Meeting

J~eeklY Project Stakeholder Meeting

Securus & Missouri DOC Project Team Meeting - Touch Point: Pre:

Transition Review

IReview Regional Summary Reports - Installation Activity

-Review Quality Control Documentation

IReview S-Gate User Interface training updates

Review Open Issues

I~ecurus & Missouri DOC ProjettTeam Meeting - Touch Point:

Transition Schedule Review

..

Reviewfinalized transition schedule

IReview Quality Control and Project Status reports

. _.

Review Huber interface status

~

'

Id

IPhone room dean-up

CustQmer meeting to transition installation materials, site prDperty,

etc.

""

I Project Monitor & C-;'~trol

.. -

14

5

1.4.1.15

1.4.1.1S.1

1.4.1.15.2

1.4.1.15.3

1.4.1.15.4

lA1.15.5

1.4.1.15.6

."

..

-"

lo.sh

.IINetwOrk Operations

Center

Site Engi"'ee'r 4 ..

Bhrs

..

IComplete walk through

Clean-up and

..

3

14

4

14

4

1.4.1.14

1.4.1.14.1

1.4.1.14.2

1.4.1.14.3

1.4.1.14.4

-

.10.5 hrs

..

Ih

I:ield Service

Technieian 2

Network Operations

Center

I

-

IFinal site review with Engineer and Project Manager

..-

1.3.1.9.2.3.6.4.1 19

..

.

1h

lId

Field Service

Technician 2

1 hr

Update Site Design / Engineering documentation

9

1.3.1.9.2.3.6.3.3 19

1.3.1.9.2.3.6.4

8

1.4.1.7.4

1.4.1.S

1.4.1.9

1.4.1.10

1.4.1.11

1.4.1.12

1.4.1.13

..

11h

I

1 hr

Llve network traffic monitoring: continuous NOC monitOring

10

1.3.1.9.2.3.6.2.4 9

1.4.1.7

1.4.1.7.1

1.4.1.7.2

1.4.1.7.3

1 hr

I

. _--

Move 25 pair cables from Incumbent to Securus SCP equipment

1.3.l.9.2.3.6.2.3 9

•

1h

I:ield Sel\lice

Technician :2

Field Service -Technician 2

11 hr

.-

J.Transi~io~

1.3.1.9.2.3.6.2.1 9

1.4.1

1.4.1.1

...

1.4.1.2

1.4.1.3

1.4.1.4

1.4.1.5

1.4.1.6

Field Sel\lice

Technician 2

Notice to MDDOC Facility Personnel - Ready for ITS Transition

1.3.1.9.2.3.6.1.3 9

1.3.1.9.2.3.6.2

[S_

1.3.1.9.2.3.6.3.2

Schedule DuratIOn

1 hr

IDebit balance verifications

1.3.1.9.2.3.6.1.2 19

1.3.1.9.2.3.6.3

Resource Names.

Phone room and equipment inspection

1.3.1.9.2.3.6.1.1 9

1.3.1.9.2.3.6.2.2 19

Our<"ttmn

Tas, Name

Outline Level

WSS

---

10.06d

O.5h

10.5h

O.Sh

10.Sh

OoSh

10.5h

0.06d

10.5h

O.Sh

10.5h

..

._-

�WB!i

Outlin!! Level

Task Name

update schedule and registers as necessary

ISecurus & Missouri DOC Project Team Meeting - Touch Point:

ITransition Progre~s Review - Central Region

Review current progress on ITS transition

IReview issues register

Review' risk register

.Iupdate schedule and registers as necessary

S"i:urus & Missouri DOC Project Team Meeting - Touch Point:

_ _,::-_ _ _ _ ,.

Transition Progress Review - Southeast Reg"'i-',o,"'n_ _ _ _ _ __

IReview current progress Dn ITS transition

Review issues register ..

IReview risk register

update schedule and registers'as necessary

IPerform Quality Control

Integration Interface Quality Control

Duration

Resource Names

Project Manager

0.5hr~

1

1

la.Shrs

IProject Manager

'10.5 hrs

0.5 hrs

10.5 hrs

0.5 hrs

jProject Manager

Project Managern

IProject Manager

Project Manager

I

Perform quality control on Huber integration interface

Perform quality control on Guarded Exchange integration interface

IQuality Engineer

I,Quality Engineer 2

Quality Engineer

3,Qualily Engineer 4

0.5 wlts

Perform Production testing

'~~ Huber integration interface

12 days

1Integration Engineer I

Perform Production testing on Guarded Exchange integration interface 2 days

jInstallation Quality Control Checkpoint 1: Customer Provisioning

NortheaStern Region

Maryville Treatment Center - 23

._ .....

•

a.06d

lo.sh

O.Sh

10.5h

O.Sh

l2.5d

._--2.Sd

lo.sw

O_Sw

)2d

1

1

10.38d

O.38d

JQuality Control AnalvsJ3h

13 hrs

-.==

ITS.::..::&:..2~...:.T::D::D_ _ _ _ _ _ _ _ _...,.:3:..h:.::r",s_ _

lwestern Missouri Correctional Center· 93 ITS & 2 TOO

Western Reception, Diagnostic & Correctional Center -111 ITS & 2

TOO

13 hrs

3 hrs

1Chillicothe Correctional Center - 92 ITS & I TOO

Central Region

1Moberly Correctional Center· 64 ITS & 1 TOO

WDrnen'~

_ -.

..

Integration Engineer 2 2d

--

Icrossroads Correctional Center -93 ITS & 2 TOO

:

I ---

!0.5WkS

I

IO.06d

O.Sh

la.sh

O.Sh

10.Sh

Project Ma·n.-ger

jProject Manager

Project Manager' - ,

a.s hrs

10.5 hrs

O.Shes' ,

I

Schedule Duration

a.Sh

J2hrs

•

Reception, Diagnostic & Correctional Center· 1{) ITS & 1 TO-O- 2 Ius

INortheast Correctional (enter - 127 ITS & 1 TOO

12 hrs

BDonvilie (orrectional & Treatment Center - 59 ITS & 1 TOD

Icremer Therapeutic Center - 6 ITS

Fulton Reception & Diagnostic Center

Inpton Correctional (enter

Algoa Correctional (enter

)JefferSOn City Correctional (enter

Southeaslem Region

IMissouri Eastern Correctional Center

Easlern Reception & Diagnostic (orrectional (enter

[POlOSi Correctional Center

South (entral Correctional (enter

1Ozark Correctional Center

Farmington Correctional Center

ISoutheast Correctional Center

•

�•

I.tm

•

4

1.4.2.3

1.4.2.3.1

1.4.2.3.1.1

1.4.2.3.2.2

1.4.2.3.2.3

I

2hrs

l:-ve.tern Reception, Diagnostic & Correctional Center -111 ITS & 2

TOO

6

2 hr•

.1

--~-~-,

Moberly Correctional Center - 64 ITS & 1 TOO

6

16

--

.!?I~S

I

Women's Reception. Oiagnostic & Correctional Center -.

.-

6

.2 hrs

& 1 TOO 2 hrs

Northeast Correctional Center - 127 ITS & 1 TOO

2 hr.

1.4.2.U.4

•

16

IBoonvilie Correctional & Treatment Center -S9'1TS & 1 TOO

2 hrs

1.4.2.~.2.5

6

Cremer Therapeutic Cente, - 6 ITS

2 hr.

1.4.2.3.2.6

.~.4.2.3.2.7

/6

--

,

-~

-.

[Fulton R@ception & Diagnostic Center

.

.~.

6

TIpton Correctional Center

1.4.2.3.2.8

16

lAlgoa.Corre~tional

1.4.2.3.2.9

1.4.2.3.3

..

Is

1.4.2.3.3.1

6

-

-

1.4.2.3.3.2

-

1.4.2.3.3.3

1.4.2.3.3.4

1.4.2.3.3.5

1.4.2.3.3.6

•

6

6

,..

~~~.

,

Southeast Correctional Center

\:n.tallation Quality Control Checkpoint 3: Equipment Testing I

Functional Validation

._--Northwest Region

",.

.IO'.25d

Field Service

Technician 3,Field

Service Technician 4

2h

Jield Service

Technician 3.Field

Service Technician 4

Field Service

Technician 3,Field

Service Technician 4

-

2h

~

2h

rId Service

Technician 3,Field

Service Technician 4

Field SerVice

Technician 5

2h

.

-

2h

Ireld Service

Technician 6,field

Service Technician 7

Field Service

Technician 6,Field

Service Technician 7

2h

2h

2h

2hrs

.. [Farmineton Correctional Center

2h

J

Field Service

Technician a,Field

Service Technician 9

2 hr.

- ...

Ozark Correctional Center

.

2h

2h

IO.2sd

2hrs

ISouth Central Correctional Center

/6

2h

I

2hrs

Polosi Correctional Center

--

2h

2 hr.

-----

..

2h

]

2 hr.

~

6

Field Service

Technician 1.Field

Service Technician 2

rldseMee

Technician 6,Field

Service Technician 7

Field Service

Technician 6,fiehl

Service Technician 7

.-

I Eastern Reception & Diagnostic Correctional Center

._.

..

16

14

S

2hrs

Missouri Eastern Correctional Center

6

1.4.2.4

1.4.2.4.1

-

O.2Sd

.lO.25d

]

2 hrs

Center

Jefferson City Correctional Center

]Southeastern..

_ Region

ls

1.4.2.3.3.7

..

2 hrs

-

'.

.I;ierd Service

Technician I.Field

Service Technician 2

Field SeNice

Technician 1. Field

Service Technician 2

2hrs

Chillicothe Correctional Center - 92 ITS & 1 TOO

]Central Region

.

-

]5

..

!;ield Service

Technician 1. Field

Service Technician 2

Field Service

Technician 1.Field

Service Technician 2

2hrs

-.

Western Missouri Correctional Center· 93 ITS & 2 TOO

.

..

'

2 hr.

Maryville Treatment Center - 23 ITS & 2 TOO

[6

..

----

I

6

1.4.2.3.1.4

]

Crossroads Correctional Center - 93 ITS & 2 TOO

16

1.4.2.3.1.3

1.4.B.2.1

..

6

1.4.2.3.1.2

._...

Installation Quality Control Checkpoint 2:Customer Pre-Installation

] Northwestern Region

15

-.

1.4.2.3.1.5

1.4.2.3.2

~

-- 2 hrs

~--.-

2hrs

2h

I;ield SeMcl'

Technician 8,Field

SeMce Technician 9

Field Sen,.ice

Technician 8.Field

Service Technician 9

2h

I

....

2h

reid Service

Technician a,Field

Service Technician 9

.. .

Field SeMel'

Technician 8,Fleld

SeMce Technician 9

[;ield Service

Technician a,Field

Service Technician 9

Field Service

Technician a.Field

Service Technician 9

"'.-

2h

2h

.

.. 2h

..

2h

D.2Sd

D.2Sd

~."~

-

�•

-23 ITS & 1 TOO

IT5& 1 TOO

Diagnostic & Correctional Center - 111 ITS & 1

i & Correctional Center· 70 ITS & 1

Correctional Center· 127 ITS & 1 TDD

& Tre~tment Center -

&lTDD

·6 ITS

Center· 58 ITS & 1 TOO

Center - 94 ITS & 1 TOO

•

1 TOO

lTOO

Control Cne<lpoint 4: On Site Customer

1.4.2.5.1.2

Crossroads COrrectional Center· 93 ITS & 1 TOO

Center -

Technician 4.Project

Technican 7,Project

Center-

TOO

•

�•

Mm.

•

1.4.2.5.2.4

6

1.4.2.5.2.5

Boonville Correctional & Treatment Center· 59 ITS & 1 TOO

16

1.4.2.5.2.6

6

1.4.2.5.2.7

16

...

rCremer Therapeutic

1.4.2.5.2.9

1.4.2.5.3

.

-.--

1.4.2.5.3.S

6

i3

0

13

1.4.5

1.4.5.1

1.51"5

~---.

I

Missouri Eastern Correctional Center· 53 ITS & 1 TOO

1.5 hrs

1.5 hrs

1.5 hrs

1.5 hrs

.-

Southeast Correctional Center ·88 ITS & 1 TOO

1.5 hrs

1.5 hrs

1Installation Quality Control Checkpoint 5: Custome, Acceptance

Account Miriager

0

1.4.4

1.5 hrs

1farmington Correctional Center- 135 ITS & I TOO

- .-

13

1.4.3

1.5hrs

... ...

Ozark Correctional Center - 26 ITS & 1 TOO

16

1.4.2.5.3.6

1.5 hrs

!south Central Conectional Center -79 ITS & I TOO

._.

6

1.4.2.5.3.4

1.511rs

..

Eastern Reception & Diagnostic Center· 167 ITS & 1 TOO

....

1

--.

--

IJefferson Citv Correctional Center· 94 ITS & 1 TOO

Southeast Region

6

1.4.2.5.3.3

_.

Algoa Correctional Center - 61 ITS & 2 TOO

16

1.4.2.5.3.2

- 6 ITS

I Fulton Reception & Diagnostic Center· 147 ITS & 1 TOO

--

16

5

1.4.2.5.3.1

C~nter

L5hrs

Tipton Correctional Center· 58 ITS & 1 TOO

6

1.4.2.5.2.8

•

. I!l!J1;m;m.

Production environment

1.4.5.2

interface to Production environment

14

4 ..hTS

...

11.5h

1.5h

reid Service

Technician 3, Project

Manager

Field Service

Technician 4,Project

Manager

"'

l.Sh

Jield Service

Technidan 5,Project

Manager

1.5h

D.19d

Jield Service

Technician 6,Project

Manager

15h

Fiel d Service

Technician 7,Project

1.511

Manager

reid Service

Technician 8,Project

Manager

field Service

Technidan 9,Project

Manager

11.5h

--

11.5h

- ....

lId

-. ....

ld

-

.

IO.5d

- ..

4h

~ntegration Manager

14h

. ..

~

Project Plan updates (risk register, issues log, schedule updates)

2hrs

Project Coordinator

2h

1.4.5.4

14

I Project Pia n upd ates (risk register, issues log, schedule updates)

2hrs

IProject Coordinator

12h

1.4.5.5

4

Project Plan updates (risk register, issues log, schedule updates)

2 hrs

Project Coordinator

2h

1.4.5.6

14

IProject Plan updates (risk register, issues log, sch~dule updates)

2hrs

1project Coordinator

2 hrs

Project Coordinator

2h

2 h"

.lProject Coordinator

J2h

Project Coordinator

2h

lId

ld

llh

1h

11h

Ih

4

1.4.5.8

14

1.4.5.9

1.5

1.5.1

1.5.1.1

1.5.1.2

1.5.1.3

1.5.1.4

.,

..

-

Project Plan updates (risk register, issues log, schedule updates]

Iproject Plan UPdat:s (risk register, issues log, schedule updates)

4

12

3

14

4

14

4

Project Plan updates (risk register, issues log, schedule updates)

I Project Close

...

Close Project Phase

IClose Project Initiation

Close Project Plan-ning

IClose Project Execution

Close Project Monitor & Control

-, ..

..

2hrs

1

..

. .llhr

1 hr

11 hr

lhr

..

1.511

4

1.4.5.7

~

1.511

JField Service

Technician 1,Project

Manager

Field Service

Technician 2,Project

Manager

1.4.5.3

•

..

11.5h__

Integration Manager

<lh"

,

1.5h

I;ield Service

Technician I,Project

Manager

. -Field Service

Technidan 2,Project

Manager

.1

I~ange control for promoting Guarded Exchange intergration

..

.,

ISite Engineer I

Site Engineer 1

IPerform Integrated Change Cont",1

Change control for promoting Huber intergration interface to

4

..

1Project

Manager,Account

Manager

Account Manager

1 day

Iin'tallation QualiW Control Checkpoint 6: Initiate Post Implementation

Site Engineering Monitoring (remote monitoring: 3D days]

1 day

Site Engineer 1

~.

- ---

'

Field Service

Technician 9,Project

Manager

I ..

IProject Manager

Project Manager

lProject Manager

Project Man~er

."

12h

--

~

�WB~

Outline le"el

1.5.1.S

4

DuratIOn

Resource Names

~chedul" Duration

Idav

Task Name

PrOject Manager

ld

IProject Manager

O.13d

llh

I

I

I

I

j

I

J

I

J

J

I

I

I

I

I

I

I

I

I

I

j

J

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

1

I

1

11 hr

I hr

I

1h;

J

I hr

:::.

Accou;'t Manager

IAccOIlnt Manager

Account Manager

1Account Manager

Account Manager

IAccount Manager

Ih

I

Ih

~

1h

1

_.

I

I

I

I:

J

I

I

I

..1

I

I

I

I

: : I.

I

I

-I

=-_...-

::I ..:

--

1

I

I

I

---..

•

1

I

~

I

)

1.S.2.3

I

I

1.5.2.2

3

14

4

10

4

10

4

10

I

1.S.2

1.5.2.1

Procurements

Securus &. Missouri DOC Project Team Meeting· Touch Point:

Customer Acceptance & A«ount Team Transition

IConfirm resolution of any open issues on issues log

Technical Support and Field SeNite Management Review

IAccount Manager

Sales'Account Team review

jAccount Manager

Estb~1i51" ongoing meeting schedules

IAccount Manager

aDS!!

•

J

-.-

-..1

I

:I

J

..1

I

J

.. 1

1

~

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

~

~

I

I

I

I

.- r

I

J

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

~

..1

I

I

J

I

I

I

I

I

I

I

I

I

I

I

I

--

•

�1[' SECURUS"

TECHNOLOGIES

1.1 Pl'olect Initiation

•

WBS

Missouri Dept. of Corrections Implementation Project

1.0 Securus Inrna1a Telephone &

Technology Project Plall

1.2 Prolect Planning

1.4 Project Monitor & Conlrol

1.3 Prolect Execution

1.4.1

Distribute Information

1.1.1

Contract Execution

1.4.1.1

Stakeholder Updates

1.1.2

Project Kickoff

1.5 Project Close

1.5.1

Close Projed: Phase

'.5.1.1

Close Project Initiation

1.4.2.1

Report Performance

Site lJ'1spections

1.2.4

ITS InstallatiOfl Timelil1e

Review

1.1.5

Scope verification

1.4.2.1

Report Performance

1.2.5

EngineeringlSite

Design/MOP updates

1.1.4

'.3.2.2

Cuet!)fIW)t [)ala Mgm!

'.3.:U

Norl...... IReglon

U.U

Ek)'-'",UI Rl!glan

1.3.:U

C...InIIReglon

1.3.4

S·Gate User Training

1.3.5

Transition Activities

1.3.5.1

Huber Data Xfer/upload·

1.3.5.2

Transfer to SewlUs

Document tnfonnation

Rev

Dl!scriptian~ Wark

Breakdown Structure {Maximum Slayer was

2/15(2011

Approwd by mmcmahon

.'

�•

AppendixD

Provisioning Checklist

•

•

�Site Name:

State:

AFCE Number:

SECURUS·

Project Manager:

1'ECHNOl..CJGIE8

Lead Technician:

CUSTOMER PROVISIONING CHECKLIST

PROJECT PREPARATION

Preparation Project Manager-

Create Installation Record within Installation Project Management System:

- Build Install Record to include:

- Site Name, State

- Inside Support Technician

- Contract ID

- Billing ANI

- AFCE Number

- Project Manager

Preparation Project Man\lgerCreate Install

Record

- Field Service Manager

- Site ID

-AFCE Outlay

o

- Field Service Technician

Review Contract, Master Service Agreement, and Statement of Work to identify specific project

requirements, including:

-Installation Scope

-Feature Requirements

- Installation Process Requirements, including timelines

o

-Service Level Agreements

-Recording Policy Requirements

Preparation Project Manager-

Update Installation Record within Installation Project Management System:

-Include:

-Installation Scope

-Feature Requirements

o

- Installation Process Requirements, including timelines

-Service Level Agreements

-Recording Policy Requirements

Preparation Project Manager I

Sales AssociatePreparation Project Manager I

Installation

Support Team

Output Installation Record and submit to Sales Associate(s) for pre-Installation review.

o

Conduct sit-down review of Installation Project, to review:

-Installation Scope

-Feature Requirements

o

- Installation Process Requirements, including timelines

-Service Level Agreements

Preparation Project Manager

Close Preparation

- Project

Manager

Lock finalized Installation Record within Installation Project Management System:

o

Signature

I

x

Project Manager

Securus Technologies, Customer Provisioning Checklist

Digital

Signature

Required

�SCN CUSTOMER PROVISIONING

Provisioning Installation

Support

Provisioning Installation

Support

Access Installation Project Management System and review Installation Recen:l.

Before proceeding, ensure all necessary information is contained within the record.

D

Access the SCN Customer Provisioning System

-Create Customer Record, using Customer Name, Customer State, and Contract 10

-Select the required call recording and storage profile from drop down menu

D

-Create Sub-Customer Record (Site), using Site Name and State

-Select appropriate time-zone from drop down menu

-Select the "Home" Data Center from drop down menu

Provisioning Installation

Support

Provisioning Installation

Support

Access the Customer Setup WIZARD within the SCN Customer Provisioning System

-Create the MAIN, BOOKING, and DISABLED Management Port Groups (MPG)

D

Select the desired MPG group from the drop down menu, and select required features and dialing

instructionsfrestrictions from the Entitlements Section of the Customer Setup WIZARD.

This includes:

-Dialing class of service, such as Collect, Debit, etc.

D

-Site Name Audio Announcement

-Enable PINs I PANs and PIN I PAN Length

-MPG Call Duration and Time Schedules

-Billing ANI Identification

INTEGRATED ACCESS DEVICE (lAD) PROVISIONING

Provisioning

Installation

Support

~

Generate lAD Config File(s) by accessing lAD Config Generation Utility

-Enter Installation Record Number

-Enter Site 10

-Enter Site Name, State

-Choose Circuit Type (MPLS or DSL)

D

-Enter lAD Port Count (8/24)

-Enter InternallP Address (from InternallP Access list)

-Enter lEC Provided ExternallP

-Enter Securus Access Tag Number (from Asset Tag list)

-Save Configuration, and Click "GENERATE CONFIG"

Provisioning Installation

Support

E-mail the lAD Config File(s) to the appropriate Field Service Technician(s).

Upload lAO Config File(s) to Installation Record within Installation Project Management System.

D

Update Installation Record to include InternallP, ExternallP, and Asset Tag for the IAD(s).

Provisioning Installation

Support, Field

Service

Work with Field Technician to apply lAD Config file(s) to lAD Device(s) during the Onsite Test and

Turn-up (T&T) process.

Provisioning Installation

Support

link lAD device(s) to Customer Record within SCN Customer Provisioning System.

-Selecl lAD Type

-Input lAD Asset Tag

-Input lAD IP Address Configuration

Securus Technologies, Customer Provisioning Checklist

D

�PROVISIONING REVIEW

Review - Project

Manager I

Installation

,:_,.,._ .. Team

Supervisor I

Engineer

Review Customer and Site Provisioning within the SCN Customer Provisioning System.

Review Installation Record within Installation Project Management System.

Validated Feature Requirements listed in the Installation Record match the features and configurations

established in the SCN Customer Provisioning System.

0

Validate IP 5<.."",,,,,,, lAD Config, and Network

Review - Project

Manager I

Installation

Support Team

Conduct sit-down review of Installation Project, to review:

-Installation Scope

-Feature Requirements

0

- Installation Process Requirements, including timelines

-Service Level Agreements

Review - Pr()ject

Manager

Lock finalized Installation Record within Instailation Project Management System:

Close Review Project Manager

Finalize and Lock Customer and Site Provisioning

x

•x

Project Manager

Installation Support Team Supervisor

x

Engineer

•

Securus Technologies, Customer Provisioning Checklist

0

Signature

I

Digital

Signature

Required

�AppendixE

Field Technician Checklist

•

•

�SECURUS~

TECHHOl.OG28

Installers Name:

Ticket

Number

Facility Narne

State:

: Date

Main Address:

Contact Name

LEGEND

~

X

'= Satisfactory/Complete

=Unsatisfactory

No Mark = Not Revie'

Site Inventory

Review Item

. __ I

Result

Notes

Does the equipment received match the equipment listed on the Sales

Order? Please include equipment receipt checklist with returned

survey.

Was all of the equipment received without damage?

Is any additional equipment required to complete project? Please

include equipment request form for any additional equipment.

Equipment Location and Security

Result

Notes

Is there evidence of any construction occurring in or around the phone

room?

Is there adequate perimeter space around the phone equipment?

Electrical

Result

Review Item

.i

Notes

Is a grounded, dedicated circuit being used to power the equipment?

Is there a secondary power source available in the phone room?

Is the equipment grounded with a #12 green insulated copper wire?

Is the equipment utilizing a UPS unit or building UPS?

Is the UPS plugged into the Towermax KSU?

Is the Towermax KSU installed correctly, and electrically grounded?

Is there lightning protection installed on the T1/C.O. side of the

system?

Is there lightning protection installed on the station side of the system? I

Review Item

Network f Telecom

Result

. Notes

Have alilines/circuits been identified, tagged, and terminated?

Please include circuiViine inventory.

Have all lines/circuits been tested?

Has the modem line and BTN been installed and tested?

. . all routers, channel banks, and lADs installed and visible on the ...

w.vork? Please include u dated network dia ram.

\

Is all wiring cleanly installed, utilizing wire management systems and

recommend best practices? Please include pictures of all phone room

wiring.

Has all network and telecom cabling been tested?

..

,

�Telephones

eel with a logical port D and facility

the port assignments been setup in the SeN

Have the phones been associated

groups?

the correct management port

Has PIN information been obtained from previous system and

provided to Installation Support Team for import?

Has

calling list information been obtained from

previous system and provided to Installation Support team for import?

x

x

Facility Installer

•

Secondary Reviewer

:·IS'\

•

�AppendixF

Text Validation Checklist

•

•

�I~=...:--->--= SECURUS-

TeCHNOil CJ(HI;S

TEST I VALIDATION CHECKLIST

State:

: Installers Name:

i Ticket

: Number

Main Address:

: Date

Facility Name

Contact Name

LEGEND

_ _ _~o

_ _ _ _ _~ _ _ _ _

Verify phone lables are correct.

Go offhook on telephone al1d check for voice prompts.

Perform positive acceptance test call.

your name.

test call and verify that both parties are notified of monitoring and

Setup private test call and verify that call is not monitored or recorded.

Perform domestic LD collect test call, select rate quote, and validate the rate.

global speed dial numbers are input, and test calls complete ;;:ou",",g;;:o,

Perform test call to

number, and verify block call flow.

ber.

�"ot Reviewed

IS

1

2

3

4

5

6

�•

Appendix G

Customer Acceptance Checklist

•

•

•

�CUSTOMER ACCEPTANCE FORM

.~

Site Name:

SECURUS·

TECHNOLOGIES

St:

AFCE Number:

Project Manager:

Customer Contact:

EQUIPMENT INSTALLATION

Notes:

Equipment Room

0

All phone equipment is professionally installed within designated

areas.

Notes:

Equipment Room

0

All phone equipment is properly labeled,

Notes:

Equipment Room

0

All telecom and electrical wiring is mounted securely, and

managed using best practices for wire/cable management.

Notes:

Equipment Room

0

The Equipment Assignment Record has been completed and is

attached the ~quipment rack.

Notes:

Equipment Room

0

All necessary equipment is grounded appropriately and using

designated power sources provided by the facility.

Notes:

Equipment Room

0

All excess eqUipment, trash, or other materials have been

removed from the equipment room.

Notes:

Telephone Installation

0

All phones have been installed in the correct locations.

Notes:

Telephone Installation

All phones have been securely mounted and inspected.

0

Notes:

Telephone Installation

All phone handsets and keypads have been inspected

0

Notes:

Telephone Installation

All informatloh placards have been installed.

0

Notes:

Telephone Installation

0

All telephones have been accurately identified, and logically

associated with their physical location.

Notes:

Workstation Installation

All workstations have been installed in designated locations.

Workstation Installation

0

Notes:

All workstations have been used to access S-Gate UI.

Securus Technologies, Customer Acceptance Checklist

0

�EQUIPMENT OPERATION

Notes:

Phone System Operation

All custom prompts (tag prompts, facility name prompts) have

been reviewed and confirmed.

0

Notes:

Phone System Operation

Detainee and called party call flows have been reviewed and

confirmed.

0

Notes:

Phone System Operation

Call time limits have been reviewed and confirmed.

0

Notes:

Phone System Operation

Call schedules have been reviewed and confirmed.

0

Notes:

Phone System Operation

Applicable phone system features have been reviewed and

verified (further defined as necessary to include all feature

requirements)

0

Notes:

Workstation Operation

0

Workstations have access to S-Gate UI, and user logins have

been provided to necessary personnel.

Notes:

Workstation Operation

S-Gate UI functionality, including reports, block/unblock, calls

schedules, li\l'e call monitoring. and audio download/CDRW) have

been tested and confirmed

0

Notes:

Data Verification

All PIN/PAN data has been uploaded or input.

0

Notes:

Data Verification

All blocked/free/privileged calling lists have been uploaded or

input.

0

Notes:

Data Verification

All phone locations (such as POD B, Left) have been correctly

input into system.

0

FORM VERIFICATION

Notes:

Field Install.dion Checklist

The Field Installation Checklist has been completed with success,

reviewed, and signed by necessary parties.

0

Test I Validation Checklist

The TesWalidation Checklist has been completed with success,

reviewed, and signed by necessary parties

Notes:

3D-Day Support Plan

Notes:

0

The post-implementation support plan (acceptance criteria, SLAs.

support con18ct, and escalation list) has been completed, and

provided to appropriate customer contacts.

0

x

x

x

Customer Contact

Project Manager

Installaton Fietl Tecnnoan

Securus Technologies, Customer Acceptance Checklist

•

�30-Day Post Implementation Acceptance

•

Installation Equipment & Provisioning User Acceptance Signature Form

Site Id: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __

Site Name:

--------------------

By my signature below I acknowledge I have reviewed the installation check list and I hereby confirm

completion ofthe scope of work as required for acceptance approval which includes equipment, system

functionality, and provisioning of the inmate phone system installed by Securus Technologies.

Facility Point of Contact Name:

Printed Name:

----------------------------

Signature: ______________________

Date:_ _ _ _ _ _ __

Install Field Technicians assigned to installation:

Printed Name:

Printed Name:

•

•

Securus Technologies, Customer Acceptance Checklist

�Appendix H

Securus Certified Financial Statement

•

•

�Page 1 ofl12

fonn 10- k.htm

•

IO-K 1 fonn10-k.htm 2009 FORM IO-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM10-K

I&l ANNUAL REPORT PURSUANT TO SECTION 13 OR lS(d) OF THE SECURITIES EXCHANGE ACT OF

1934

o

For the fiscal year ended December 31, 2009

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR IS(d) OF mE SECURITIES EXCHANGE ACT OF

1934

F or the transition period from to

Commission file number 333-124962

SECURUS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

20-0673095

(I.R.S. Employer

Identification Number)

Delaware

State or other jurisdiction of

incorporation or organization

•

14651 Dallas Parkway, Suite 600

Dallas, Texas 75254-8815

(972) 277-0300

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Securities registered pursuant to Section 12(b) oftbe Act:

None

Securities registered pursuant to Section 12(g) oftbe Act:

11% Second-priority Senior Secured Notes due 2011

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 40S of the Securities Act. Yes 0 No I&l

Indicate by check mark ifthe registrant is not required to file reports pursuant to Section 13 or Section IS(d) of the Act. Yes 0 No lID

Indicate by check mark whether the registrant (I) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchangc Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the PW;t 90 days. Yes I&J No 0

Indicate by check mark whether the registrant has submitted elcetronically and posted on its eorporatc Website, if any, every Interactive Date File

required to be submitted and posted pursuantto Rule 405 of Regulation S-T (§229.40S of this chapler) during the preceding 12 months (or for such shorter

period thallhe registrant was required to submit and post such files). Yes 0 No 0

Indicate by check mark if disclosure of delinquent filers pursuant to lIem 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and

will not be contained. tI) the best ofthe registrant's knowledge, in definitive prOJl:y or information statements incorporated by reference in Part III of this Form

10-K or any amendment to this Form IO-K. IE

Indicate by check mark whether the registrant is a large accelerated tiler, an accelerated filer, or a non-accelerated tiler, or a smaller reporting company.

See the definitions of "large aceclerated filer," "aecelerated flier'· and "smaller reporting company" in Rule 12b-2 ofthe Exchange Act.

Large aecelerated filcr 0 Accelerated tiler 0 Non-accelerated filer lID Smaller reporting company 0

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes 0 No lID

No established published trading market exists for either the common stock, par value So.OOl per share, of Securus Technologies, Inc. or the Class B

common stock, par valllc $0.001 per share, of Securus Technologies, Inc.

Shares outstanding of each of the registrant's classes of common stock:

Class

Class A Common Stock

Class B Common Stock

Outstanding lit Marth 1, 2010

14,132 shares

135,221 sharcs

Documents Incorporated By Reference

•

file:I/Z:\RFP Technician Files\Financials\2009 Financials\2009 formlO-k.htm

3/29/2010

�fonn 10-khtm

Page 2 of 112

TABLE OF CONTENTS

PART I

JJEM I. BUSIN~S.S

ITEM IA. RISK FACTORS

ITEM I B. UNRESOLVED STAFF COMMENTS

JTEM 2..J~.ROPERTIES

1TEM 3. LEGAL PROCEEDINGS

JTEM 4. RESERVED

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQillTY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

ITEM 6. SELECTED FINANCIAL DATA

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

PPERATIONS

ITEM 7A. OUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

ITEM !LCQNS.OLIDA TED FIN~1:i..CJALSTAJ'EMENTS

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

fINANCIAL DISCLOSURES

iI.EM 9A. CONTRQL$ AN"D£.R..PCEDURES

]IEM 9B. OTHER INFORMATION

3

3

•

12

25

25

25

26

27

27

28

30

40

43

66

67

69

~rn

~

ITEM 10. DIRECTORS. EXECUTIVE OFFICERS AND CORPORATION GOVERNANCE

JTEM I LEXE_CJJ.1'lYEJ:OMPENSATIQN

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

ITEM J3.,J2ERTAIN REL.~I.lONSHIP$.AND RELATED "(MN,SACIIONS, AND DIRECTO~

69

73

80

81

JNDE~E.NnENCE

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

PARVY

ITEM tLE.XHtBll'SAND FINANCIAL STA_TEME.NTSCHEDULES

82

84

84

•

2

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 formIO-k.htm

3/29/2010

�Page 3 of 112

form I O-k.htm

•

PART I

ITEM 1. BUSINESS

Overview

We are one of the largest independent providers of inmate telecommunications services to correctional facilities operated

by city, county, state and federal authorities and other types of confinement facilities, such as juvenile detention centers and

private jails, in the United States and Canada. With 66 patents and and approximately 55 patent applications filed or in

process, we believe we are the leading technology innovator in the correctional industry. As of December 31,2009, we

provided service to approximately 2,400 correctional facilities in the United States and Canada, and processed over 10 million

calls per month during 2009.

Our core business consists of installing, operating, servicing and maintaining sophisticated call processing systems in

correctional facilities and providing related services. We enter into multi-year agreements (generally three to five years)

directly with the correctional facilities in which we serve as the exclusive provider of telecommunications services to inmates.

In exchange for the exclusive service rights, we pay a negotiated commission to the correctional facility based upon revenues

generated by actual inmate telephone use. On a limited basis, we may also partner with other telecommunications companies

whereby we provide our equipment and, as needed, back office support including validation, billing and collections services.

and charge a fee for such services. Based on the particular needs of the corrections industry and the requirements of the

individual correctional facility, we also sell platforms and specialized equipment and services such as law enforcement

management systems and call activity reporting.

We sell information management systems that work in conjunction with our communications systems and allow facilities

managers and law enforcement personnel to analyze and manage data to reduce costs, prevent and solve crimes and facilitate

inmate rehabilitation through a single user interface. We also offer investigative tools and bad debt risk management services

based on the particular needs ofthe corrections industry and the requirements of the individual correctional facility.

•

]n addition, we sell offender management systems and related systems and services through our wholly-owned subsidiary

Syscon Holdings, Ltd. ("Syscon"). Syscon is an enterprise software development company for the correctional facility

industry. Syscon's core product is a sophisticated and comprehensive software system utilized by correctional facilities and

law enforcement agencies for complete offender management. Syscon's system provides correctional facilities with the ability

to manage and monitor inmate parole and probation activity and development at a sophisticated level. We believe our offender

management software represents the leading enterprise solution for the corrections industry. Our offender management

software is operating in more than 500 correctional facilities and probation offices maintaining records for over 400,000

offenders in the United States, Canada, the United Kingdom and Australia.

The inmate telecommunications industry requires highly specialized systems and related services in order to address the

unique needs of the corrections industry. Security and public safety concerns require that correctional facilities have the ability

to control inmate access to telephones and certain telephone numbers and to monitor inmate telephone activity. In addition,

concerns regarding fraud and the credit quality of the parties billed for inmate telephone usage have led to the development of

billing and validation systems and procedures unique to this industry,

We estimate that the inmate telecommunications market opportunity for city, county, state and federal correctional

facilities in the United States is approximately $1.2 billion and the offender management technology market opportunity is

approximately $1.0 billion worldwide.

Our business is conducted primarily through our three principal subsidiaries: T-Netix, Inc. ("T-Netix"), acquired in

March 2004, Evercom Holdings, Inc. ("Evercom"), acquired in September 2004, and Syscon, acquired in June 2007.

For the year ended December 31, 2009, our revenues were $363.4 million, of which approximately 86% represented direct

call provisioning to correctional facilities, 6% represented sales and services related to our offender management software and

8% represented the wholesale service provision of solutions, telecommunications and billing services to our

telecommunication carrier partners.

•

Securus was incorporated in Delaware on January 12,2004. We maintain a web site with the address

www.securustech.net. We are not including the information contained on our web site as a part of, or incorporating it by

reference into, this Annual Report on Form 10-K.

3

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 forml0-k.htm

3/2912010

�form 1O-k.htm

Page 4 of 112

Industry Overview

The corrections industry has experienced sustained growth over the last two decades as a result of societal and political

trends. Anti-crime legislation, limitations on parole and spending authorizations for crime prevention and construction of

additional correctional facilities have contributed to this industry growth.

•

The United States has one of the highest incarceration rates of any country in the world. The U.S. Department of Justice

estimates that as of year end 2008, there were approximately 2.3 million inmates housed in U.S. correctional facilities, or

approximately one inmate for every 133 U.S. residents. Of this total, approximately two-thirds were housed in federal and

state prisons and approximately one-third were housed in city and county correctional facilities. According to U.S.

Department of Justice statistics, the inmate population in federal and state prisons, which generally house inmates for longer

terms than city and county facilities, increased from approximately 1.2 million at December 31, 1998 to approximately

1.5 million at December 31,2008, representing an average annual growth rate of approximately 2.2%. The inmate population

in city and county facilities, which generally house inmates for terms of one year or less, increased from approximately 0.6

million at December 3.1, 1998 to approximately 0.8 million at December 31, 2008, an average annual growth rate of

approximately 2.9%. Between December 31, 1998 and December 31, 2008, the overall incarcerated population grew an

average of 2.4% annually. Population growth during the 12-month period ending December 31,2008 was higher in local jails

(up 0.7%) than in federal prisons (up 0.6%), and state prisons showed no growth.

The corrections industry requires specialized information technology, telecommunications systems and related services.

Security and public safety concems associated with inmate telephone use require that correctional facilities have the ability to

control inmate access to telephones and to certain telephone numbers and to monitor inmate telephone activity. In addition,

concems regarding fraud and the credit quality of the parties billed for inmate telephone usage have also led to the

development of systems and procedures unique to this industry. Correctional facilities also have unique information

technology requirements relating to managing and monitoring inmate (and probation) activity and development. These include

offender management, financial applications, health and activity records as well as predictive tools for future inmate behavior.

Facilities are increasingly seeking to utilize enhanced automated systems to offset the challenges of budget cuts, understaffing

and prison overpopulation.

Within the inmate telecommunications industry, companies compete for the right to serve as the exclusive provider of

inmate calling services within a particular correctional facility. Contracts may be awarded on a facility-by-facility basis, such

as for most city or county correctional systems, which generally include small and medium-sized facilities, or system-wide,

such as for most state and the federal prison systems. Generally, contracts for federal facilities and state systems are awarded

pursuant to a competitive bidding process, while contracts for city and county facilities are awarded both through competitive

bidding and negotiations with a single party. Contracts generally have multi-year terms and typically contain renewal options.

As part ofthe service contract, the service provider generally installs, operates and maintains all inmate telecommunications

equipment. In exchange for the exclusive contract rights, the service provider pays a commission to the operator of the

correctional facility based upon inmate telephone use. These commissions have historically been used by the facilities to

support their law enforcement activities.

•

Historically, offender management systems have been developed independently and internally by government agencies to

provide basic information management capabilities to run the business of an incarceration facility. Often, these agencies have

outsourced design, or certain aspects thereof, to third party consultants. We are one of a very small group of providers offering

a comprehensive off-the-shelf software package for offender management and related activities. The market is highly

fragmented and it is our belief that most of the "home-grown" systems may not effectively manage the inmate, parole and

probation populations. We believe that only a fraction of the market has been outsourced to firms that develop enterprise

inmate systems like we do, and that we have the largest portion ofthe outsourced market. Our systems currently track over

400,000 oftbe approximate 10 million people estimated to be incarcerated worldwide. For extremely large projects, we often

partner with larger systems integrators, such as mM and Hewlett Packard (formerly Electronic Data Systems).

4

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 fonnlO-k.htm

3/2912010

�Page 5 of112

formlO-k.htm

•

Competition

In the inmate telecommunications business, we historically have competed with numerous independent providers of

inmate telephone systems such as Global Tel*Link, as well as regional bell operating companies ("RBOCs"), local exchange

carriers ("LECs") and interexchange carriers ("IXCs") that include AT&T and Embarq. Unisys also has recently entered the

market. We believe that the principal competitive factors in the inmate telecommunications industry are system features and

functionality, system reliability and service. the ability to customize inmate call processing systems to the specific needs of the

particular correctional faCility, relationships with correctional facilities, rates of commissions paid to the correctional facilities,

end-user rates, called party and inmate customer satisfaction levels and the ability to identify and manage credit risks and bad

debt. We seek to cumpete for business on local. county, state and federal levels, and in privately managed correctional

facilities.

We believe that we are well positioned to expand our market share by offering new and enhanced products to our

existing customers, and attracting new facilities with "one stop shopping" for their communications and tecbnology needs at a

lower cost than our competitors. We believe we are well positioned relative to our competitors because of our belief that our

costs are lower as a result of our packet-based architecture and proprietary bad debt risk management systems. These lower

costs. coupled with our technological capabilities and robust patent portfolio enable us to make attractive bids to our

prospective or existing customers.

In the offender management market, we compete with a small group of offender management software providers, each of

whom we believe is smaller than we are. We also compete with large and small software consultant organizations who do not

offer off-the-shelf prepackaged software, but who can develop systems from scratch to the client's specifications.

Printary Sources of Revenues

The following chart summarizes the primary sources of our revenues by reportable segment for the year ended December

31,2009. See Note 5, Segment Information, in the Notes to the Consolidated Financial Statements in Part II of this report for

financial information about each of our segments.

•

% of Total

Revenue Source

Direct Call Provisioning

Description

Revenues

86% Direct call provisioning services through multi-year contracts directly to local

correctional facilities as well as large county jails and state departments of

corrections facilities. No direct customer accounted for more than 6% of our

total direct call provisioning revenues for the year ended December 31, 2009.

Wholesale Services

8% Wholesale Services include both solutions and billing services (validation, fraud

management and billing and collection services to third parties including some

ofthe world's largest communication service providers) and telecommunications

services (equipment, security enhanced call processing, validation and customer

service and support to corrections facilities through contracts with other inmate

telecommunications providers).

Offender Managernent Software

Software sales and development services for complete offender management,

6%

providing correctional facilities with the ability to manage and monitor inmate,

parole and probation activity and development at a sophisticated level.

5

•

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 fonnl O-k.htm

3129/2010

�form 10·k.btm

Page 6 of 1 12

Direct Call Provisioning

We provide inmate telecommunications services directly as a state-certificated telecommunications provider to

correctional facilities. In a typical arrangement, we operate under a site-specific, exclusive contract, generally for a period of

three to five years. We provide the equipment, security-enhanced call processing, validation, and customer service and support

directly to the facility. We bill calls via the called party's local telephone bill, via our own proprietary billing platform or

through prepaid products purchased by the inmate or the inmate's called party. Direct call provisioning margins are

substantially higher than that of our wholesale services because we receive the entire retail value of the call. In our direct caIl

provisioning business, we are responsible for paying customer commissions, line charges and other operating costs, including

billing and bad debt oosts. Consequently, our gross profit dollars are higher compared to our wholesale services.

Wholesale Services

Our wholesale services business consists of (1) validation, uncollectible account management and billing services

(solutions services), (2) equipment, security enhanced call processing, call validation and service and support through the

primary inmate telecommunications providers (telecommunications services) and (3) the sale of equipment to other

telecommunications companies as customers or service partners. In 2009, we decided to no longer pursue a wholesale

strategy but rather will pursue business on a direct call provisioning basis only.

In our direct call provisioning and wholesale services businesses, we accumulate call activity data from our various

installations and bill our revenues related to this call activity against prepaid customer accounts or through direct billing

agreements with LEC billing agents, or in some cases through billing aggregators that bill end users. We also receive payment

on a prepaid basis for the majority of our services and record deferred revenue until the prepaid balances are used. In each

case, we recognize revenue when the calls are completed and record the related telecommunication costs for validating,

transmitting. billing and collection, bad debt, and line and long-distance charges, along with commissions payable to the

facilities. In our telecommunications services business, our service partner bills the called party and we either share the

revenues with our service partner or receive a prescribed fee for each call completed. We also charge fees for additional

services such as customer support and advanced validation.

Offender Management Software

We develop enterprise software for the correctional facility industry. We believe that we have the most functionally

complete offender management system available on the market. Our core product is a sophisticated and comprehensive

software system, "ELITE," utilized by correctional, probation and parole agencies for complete offender management. Our

system enables these clients to address the increasing challenge of managing an ever-growing number of offenders in

confinement and in the community on a cost-efficient basis.

•

Our offender management software is the centerpiece for the United Kingdom's National Offender Management

Information System for Her Majesty's Prison Service project, with Hewlett Packard (formerly Electronic Data Systems Inc.

("EDS") providing overall project management and certain testing and consulting services. Our offender management software

operates in more than 500 correctional facilities and probation and parole offices maintaining records for over 400,000

offenders in the United States, Canada, the United Kingdom and Australia.

Our offender management revenues have four main components:

•

License fees: The product purchase cost, providing clients with the license to use the core platform;

•

Implementation fees: The revenue associated with the physical installation of the system;

•

Consulting fees: Most of this work is done prior to implementation. The primary activities include: planning, design,

consultation, debugging, customization, etc.

Software maintenance and support: These post-sale fees provide a future annuity stream as we continue to generate fees

from assistance with new modules, training, version upgrades, etc.

Customers

We have direct contracts with federal, state and local agencies to provide inmate telecommunications services on either an

exclusive basis or jointly with another provider to approximately 2,400 correctional facilities ranging in size from small

municipal jails to large, state-operated facilities, as well as other types of confinement facilities, including juvenile detention

file:IIZ:\RFP Technician Files\Financials\2009 Financials\2009 formIO-k.htm

3/29/2010

•

�Page 7 of 112

fonn 10-k.htm

•

centers and private jails.

Most of our direct call provisioning contracts have multi-year terms (generally three to five years) and typically contain

renewal options. We often seek to negotiate extensions of our contracts before the end of their stated tenns. For the year ended

December 31, 2009, we retained approximately 84% of our annualized revenue up for renewal. Many of our contracts provide

for automatic renewal unless terminated by written notice within a specified period of time before the end of the current term.

6

•

•

file://Z:\RFP Technician Files\Financials\2009 Financials\2009 fonnlO-k.htm

312912010

�fonn1O-k.btm

Page 8 of 112

In the ofTender management software segment, our customers consist typically oflarge national·and state or provincial

incarceration agencies, including Her Majesty's Prison Service in the United Kingdom via a sub-contracting agreement with

Hewlett Packard (formerly EDS), along with several states and provinces in the United States, Canada and Australia. We

believe that once a customer has selected us for offender management software and related services, it is less likely to switch

systems due to the high cost of switching. As a result, we have a strong growing base of customers for our new versions,